Presented by Mark Gallagher

Quick Hits

- Solid December Caps Strong Year for Markets

- Fixed Income Continues to Rally

- Economic Updates Show Continued Growth

- Focus on the Fed

- Risks to Monitor

- Positive Outlook for the New Year

Solid December Caps Strong Year for Markets

Markets continued to rally in December, with the positive returns during the month contributing to a strong end to the year. The S&P 500 gained 4.54 percent in December, 11.69 percent in the fourth quarter, and an impressive 26.29 percent over the course of the year. The Dow Jones Industrial Average (DJIA) was up 4.93 percent for the month, 13.09 percent for the quarter, and 16.18 percent for the year. The technology-heavy Nasdaq Composite saw the largest gains with the index up 5.58 percent in December, 13.79 percent during the quarter, and 44.64 percent for the year. Markets were boosted by signs of continued economic growth and falling interest rates at year-end.

Fundamental factors were supportive for markets to end the year. Per Bloomberg Intelligence, the average earnings growth rate for the S&P 500 in the third quarter was 4.48 percent. This was notably better than analyst estimates at the start of earnings season for a 1.22 percent decline in earnings. The better-than-expected results during the quarter were widespread, as earnings growth in most sectors beat expectations. Over the long run fundamentals drive market performance, so the return to solid earnings growth during the quarter was a positive sign for investors.

Technical factors were also supportive during the month, as all three major U.S. indices ended the month well above their respective 200-day moving averages. This now marks two consecutive months with all three indices ending the month above trend. The 200-day moving average is a widely monitored technical signal, as prolonged breaks above or below this level can signal shifting investor sentiment for an index. The combination of improving fundamentals and supportive technicals to end the year are a good sign for U.S. equities as we head into the new year.

The story was much the same internationally, as a year-end rally helped support solid performance for international stocks over the quarter and year. The MSCI EAFE Index gained 5.31 percent in December, 10.42 percent during the quarter, and a solid 18.24 percent throughout the course of the year. The MSCI Emerging Markets Index gained 3.95 percent in December, 7.93 percent for the quarter, and 10.27 percent for the year. Technical factors were supportive for international stocks to end the year, with both the MSCI EAFE and MSCI Emerging Markets indices finishing the month above trend. This now marks two straight months with continued technical support for foreign stocks after a three-month stretch from August through October where both indices fell below their respective trendlines.

Fixed Income Continues to Rally

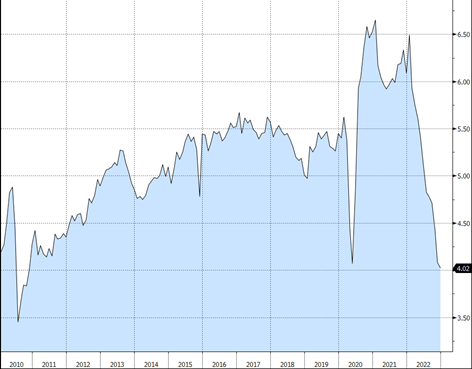

Fixed income markets continued to rally to end the year, supported by falling interest rates. The 10-year U.S. Treasury Yield fell from 4.37 percent at the end of November to 3.88 percent at the end of December. Short-term rates fell as well, with the two-year Treasury yield dropping from 4.73 percent at the end of November to 4.23 percent to end the year. The Bloomberg Aggregate Bond Index gained 3.83 percent for the month and 6.82 percent for the quarter. The strong fourth quarter helped offset earlier weakness for the index, which finished the year with a 5.53 percent return.

High-yield fixed income also performed well to end the year. The Bloomberg U.S. Corporate High Yield Index gained 3.73 percent for the month, 7.16 percent for the quarter, and 13.45 percent throughout the course of the year. High-yield credit spreads ended the year at 3.32 percent, which was well below the 2023 high of 5.22 percent we saw in March and the 3.84 percent level at the end of November. The fall in credit spreads to close the year indicates that investors ended the year with a rising appetite for riskier, high-yield securities.

Economic Updates Show Continued Growth

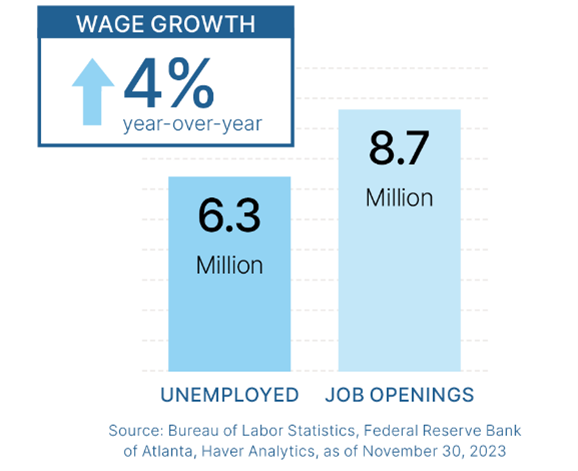

The economic updates released in December painted a picture of continued economic growth to end the year. Hiring accelerated in November, with a better-than-expected 199,000 jobs added during the month. We also saw a rebound in consumer confidence in December, as increased consumer optimism caused both major measures of consumer sentiment to end the year at multi-month highs.

The improved consumer sentiment was due in part to further progress in the fight against inflation. Headline consumer inflation fell to 3.1 percent on a year-over-year basis in November, well below the recent high of 9.1 percent that we saw in June 2022. While there is still work to be done to get inflation back down to the Federal Reserve’s 2 percent target, the improvement we’ve seen over the past two years is an encouraging sign that we are heading in the right direction. Consumers responded to the falling inflation figures by lowering their inflation expectations, which in turn helped support the rise in sentiment at year-end.

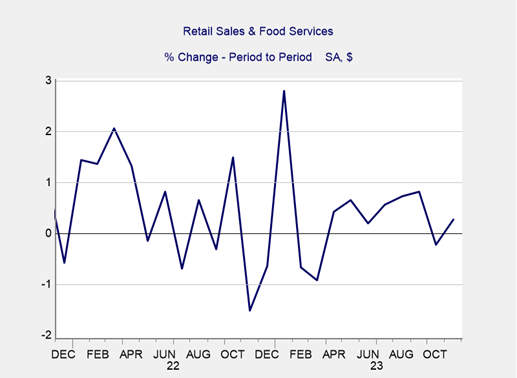

The improving confidence was an encouraging sign as historically higher levels of confidence have supported faster spending growth. Speaking of spending growth, retail sales and personal spending both improved in November, which is a good sign for sales during the busy holiday season. As you can see in Figure 1 below, the 0.3 percent rise in retail sales in November represented a rebound following a surprising drop in sales in October.

Figure 1: Retail Sales & Food Services, December 2020–Present

Given the importance of consumer spending on the overall economy, the return to spending growth, and improved confidence at year-end are a positive signal for the economy as we kick off the new year.

The Takeaway

– There are signs of continued economic growth at year-end.

– Improved consumer confidence should support spending and economic growth in the new year.

Focus on the Fed

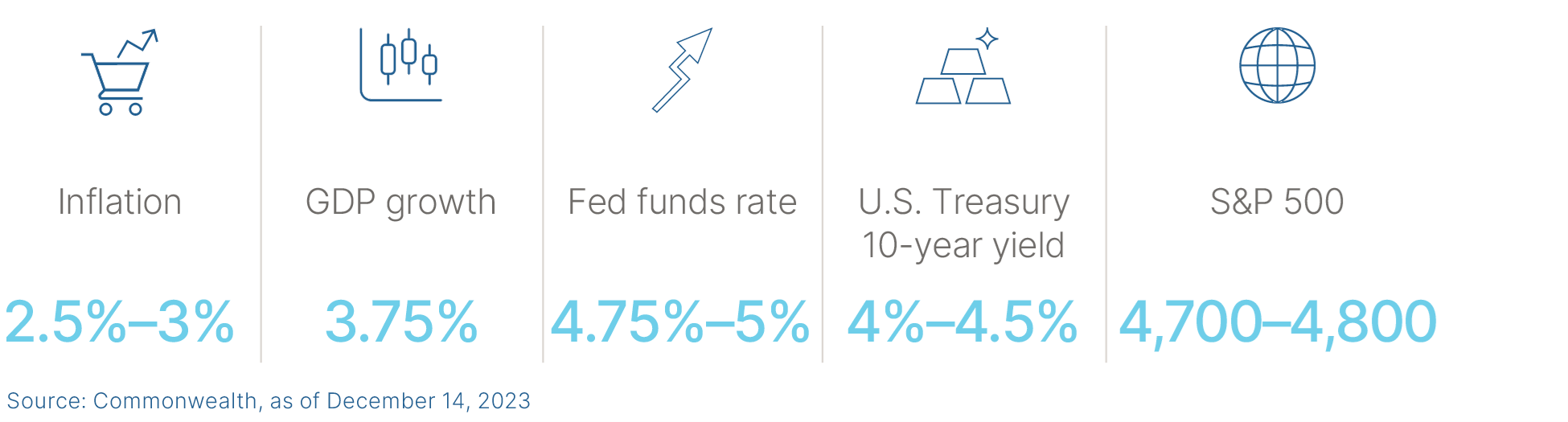

With inflation continuing to show signs of improvement and markets rallying on the news, one of the major question marks as we enter 2024 is what the Fed has planned for monetary policy throughout the course of the year. The Fed kept interest rates unchanged at its December meeting and Fed chair Jerome Powell indicated in his post-meeting press conference that the central bankers were considering cutting interest rates in 2024. He did indicate that the timing for any future cuts will remain dependent on developments in the economic data.

We ended the year with markets pricing in a total of six interest rate cuts throughout 2024. Fed members on the other hand ended the year projecting a median of three interest rate cuts in 2024. This disconnect between Fed and market rate expectations will be worth monitoring in the months ahead, as it could represent a risk to markets if investors overestimate the Fed’s willingness to cut rates throughout the course of the year.

Any talk of rate cuts will be dependent on how inflation and the economy develop in 2024. While the most likely path forward is for continued modest improvement in the months ahead, we could still see inflation reaccelerate, which in turn could lead to delayed rate cuts or even rate hikes at future Fed meetings. While the progress we’ve made so far in combating inflationary pressure has been impressive, we’re not in the clear when it comes to inflation and the Fed.

The Takeaway

– Despite positive progress in combating inflation, questions on the path of monetary policy in 2024 remain.

– The Fed and inflation will continue to present a risk to markets in 2024.

Risks to Monitor

While the Fed and inflation remain the most immediate risks, there are other risks to markets and the economy. Domestically, the U.S. elections in November are approaching and could lead to uncertainty in the second half of the year.

International risks remain as well, highlighted by ongoing wars in Europe and the Middle East. While the immediate market impact from the current conflicts has been muted, we could see an escalation that could lead to further instability in the regions. International shipping and supply lines may be especially vulnerable to rising tension in the Middle East and this will be an important area to monitor in the months ahead given the importance of international trade in the fight against inflation.

Finally, we also have unknown risks that could negatively impact markets. At this time last year few investors were talking about weakness in the U.S. banking industry or a potential government default, both of which caused brief bouts of market turbulence in 2023.

The Takeaway

– Market and economic risks remain, with inflation and the 2024 elections serving as the primary risks domestically.

– International concerns remain, which should be monitored.

Positive Outlook for the New Year

Despite the real risks that remain for markets and the economy, the overall outlook remains positive as we head into the new year. Market fundamentals and technicals ended the year on a high note with a return to earnings growth and solid technical support toward year-end. Additionally, economic fundamentals continue to show signs of a healthy, expanding economy which should set the stage for continued market gains in 2024.

Consumer spending remained impressively resilient throughout most of 2023 and improved consumer confidence at year-end should support continued spending in 2024. Business confidence and spending also showed signs of solid growth to end the year. Looking forward, we appear poised for continued positive economic and market performance in the months ahead.

There are real risks to this outlook that remain. Inflation, the Fed, and rising geopolitical risk remain front of mind as we head into the new year but other risks may develop as well.

It’s important to remember that even in strong years for markets, investors can face a bumpy ride along the way. Going back to 1980, the average intra-year price decline (the average annual price decline from peak-to-trough during the year) for the S&P 500 was 14.2 percent, while the average annual return was 9 percent. This means that even though the S&P 500 averaged high single-digit annual returns over this time, periods with selloffs were a common feature almost every year. This was true in 2023, as the S&P 500 fell by 10 percent from peak-to-trough during the year but ended the year up more than 26 percent on a total return basis.

Given the history of volatility for equity markets and the potential for short-term uncertainty due to the risks markets face, a well-diversified portfolio constructed to withstand bouts of market turbulence remains the best path forward for most investors. If concerns remain, you should reach out to your financial advisor to discuss your financial plans.

Disclosure: Certain sections of this commentary contain forward-looking statements based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. Past performance is not indicative of future results. Diversification does not assure a profit or protect against loss in declining markets. All indices are unmanaged and investors cannot invest directly into an index. The Dow Jones Industrial Average is a price-weighted average of 30 actively traded blue-chip stocks. The S&P 500 Index is a broad-based measurement of changes in stock market conditions based on the average performance of 500 widely held common stocks. The Nasdaq Composite Index measures the performance of all issues listed in the Nasdaq Stock Market, except for rights, warrants, units, and convertible debentures. The MSCI EAFE Index is a float-adjusted market capitalization index designed to measure developed market equity performance, excluding the U.S. and Canada. The MSCI Emerging Markets Index is a market capitalization-weighted index composed of companies representative of the market structure of 26 emerging market countries in Europe, Latin America, and the Pacific Basin. It excludes closed markets and those shares in otherwise free markets that are not purchasable by foreigners. The Bloomberg Aggregate Bond Index is an unmanaged market value-weighted index representing securities that are SEC-registered, taxable, and dollar-denominated. It covers the U.S. investment-grade fixed-rate bond market, with index components for a combination of the Bloomberg government and corporate securities, mortgage-backed pass-through securities, and asset-backed securities. The Bloomberg U.S. Corporate High Yield Index covers the USD-denominated, non-investment-grade, fixed-rate, taxable corporate bond market. Securities are classified as high-yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below.

Mark Gallagher is a financial advisor located at Gallagher Financial Services at 2586 East 7th Ave. Suite #304, North Saint Paul, MN 55109. He offers securities and advisory services as an Investment Adviser Representative of Commonwealth Financial Network®, Member FINRA/SIPC, a Registered Investment Adviser. He can be reached at 651-774-8759 or at mark@markgallagher.com

Authored by the Investment Research team at Commonwealth Financial Network.

© 2024 Commonwealth Financial Network