Presented by Mark Gallagher

At the start of 2023, we saw dire headlines about the economy and the markets despite positive economic data. Ultimately, the results this year followed the data, not the headlines. Yes, there were (and are) many concerns and risks. As long as the data stays solid, however, so should the results. And that’s worth keeping in mind looking ahead to 2024, too. Although we see some economic slowing, fundamentals remain sound—and that should support the markets.

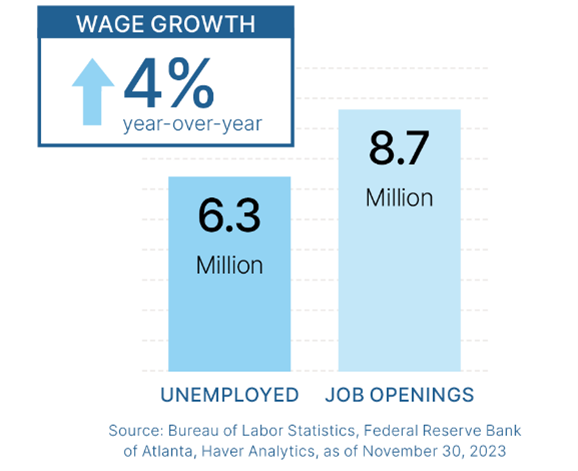

So, what does 2024 hold? If you look at headlines, you see a recession, high inflation, trouble abroad, and a market at serious risk. But if you look at the data, the picture is much brighter. Americans are getting jobs and earning more money. Businesses are investing in people, buildings, and equipment. Companies are expected to earn more money next year than this year, driven by sustained consumer spending. In other words, the data says the expansion continues. And, again, if we’re choosing to believe the headlines or the data, the latter is more trustworthy.

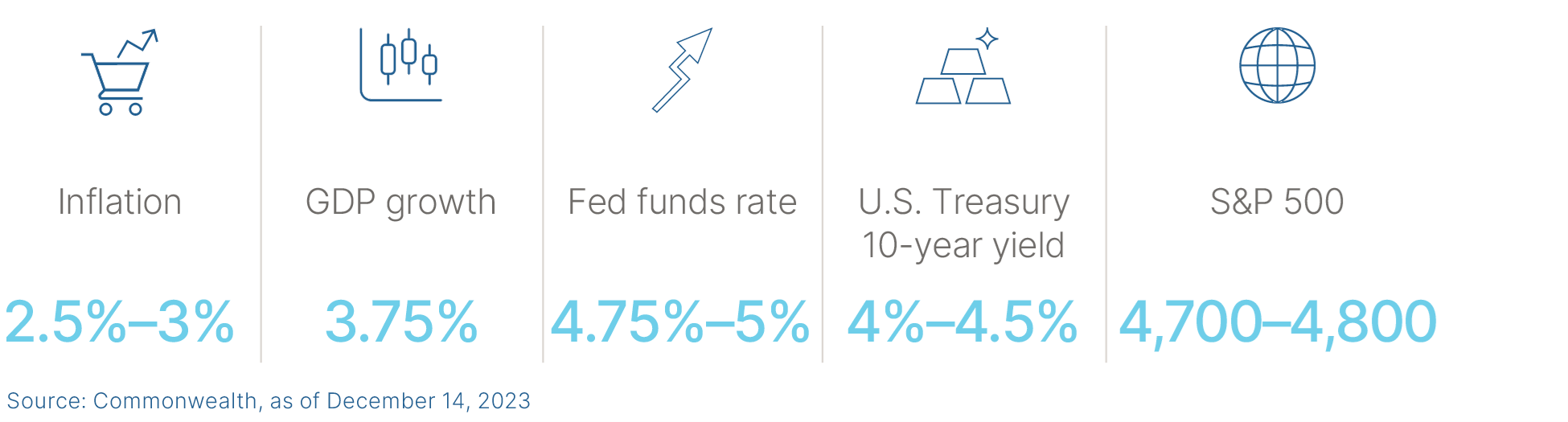

2024 Year-End Expectations

A Solid Economic Foundation

Analyzing the economy is simple: people earn and spend money, and businesses hire and invest to support that spending. As long as both pieces are in place, as they are currently, the foundation is solid. Job growth, in particular, remains healthy. Although we’ve seen a slowdown in the employment market, it decreased from extremely high levels and is approaching normal. This normalization is a good thing because it should help keep inflation contained. Similarly, we’ve seen a pullback in consumer confidence to levels typical of the mid-2010s, and business investment has slowed to more typical levels as well. All reflect a return to normal, which is a good thing.

One reason this is positive: a normal economy should generate more normal levels of inflation. That is what we’ve seen in 2023 and what we expect to continue in 2024. Inflation has dropped significantly this year and should continue to do so for the next several months. With housing, we know values have been slowing and rents declining, and that will show up in inflation numbers over the next several months. We also see moderating wage and spending growth. Overall, these slowing trends should continue bringing inflation down into early next year.

Interest Rates and Their Impact

With inflation decreasing, we should see interest rates start to pull back from current levels. Although we likely won’t see a significant decline, we also shouldn’t see rates continue to move higher. As inflationary pressures ease, and with longer-term rates much higher than they were at the start of the year, 2024 should also see tighter financial conditions. This is already slowing growth and making further rate hikes by the Federal Reserve (Fed) unnecessary. The interest rate risk is now much lower than it has been—and it should decline even further in the coming year. We may even see rate cuts in 2024, which could spark financial markets again. Overall, policy risks for 2024 are much lower than they were in 2023.

Earnings have come in above expectations for the third quarter of 2023 and are expected to keep improving through next year. A combination of a growing economy, a surprising level of recent productivity growth, and a steadying financial environment is allowing companies to sell more and improve operations, which is showing up on the bottom line. Rising earnings allow stock prices to climb even in a difficult financial environment, which is undoubtedly a good thing.

And, though we have experienced a difficult financial environment, recent signs indicate it may be easing as rates pull back. Higher rates mean lower valuations, which has been the main driver behind recent stock market declines. As rates moderate, or even pull back a bit, there is an opportunity for markets to rise even further on higher valuations.

Risks and Opportunities Ahead

Of course, we could see the economy slow even further, which would put many of these gains at risk. More political dysfunction in the U.S. (remember, 2024 is a presidential election year) could derail the expansion. A wider war in Europe or the Middle East could do the same. If inflation comes back, we will certainly see higher rates, which will affect everything. So, there are real risks.

But the same was true at the start of 2023. We saw political dysfunction, a Middle East war, and rapidly rising interest rates—yet we still did okay. There are many risks baked into the economy and markets right now, so things don’t have to go perfectly for us to see real opportunities; they just have to go better than expected. In that sense, it’s a good thing expectations are low.

A Positive Outlook for 2024

There’s no doubt real risks remain. But that’s always been the case, and 2024 will likely be no different. Here in the U.S., we are relatively isolated from many of the world’s problems and can continue to grow regardless. With the labor market healthy, businesses continuing to expand, and inflation coming under control, the economy and the markets can still fare well despite the problems. Pay attention to the risks but keep an eye on the opportunities. It worked in 2023 and is likely to work in 2024, too.

Certain sections of this commentary contain forward-looking statements that are based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. Investments are subject to risk, including the loss of principal. Past performance is no guarantee of future results. This material is intended for informational/educational purposes only and should not be construed as investment advice, a solicitation, or a recommendation to buy or sell any security or investment product.

Authored by Brad McMillan, CFA®, managing principal, chief investment officer, at Commonwealth Financial Network®.

Mark Gallagher is a financial advisor located at Gallagher Financial Services at 2586 East 7th Ave. Suite #304, North Saint Paul, MN 55109. He offers securities and advisory services as an Investment Adviser Representative of Commonwealth Financial Network®, Member FINRA/SIPC, a Registered Investment Adviser. He can be reached at 651-774-8759 or at mark@markgallagher.com

© 2024 Commonwealth Financial Network