Presented by Mark Gallagher

Quick Hits

- Positive Start to the Year

- Mixed Month for Bonds

- Economic Growth Continues

- Update from the Fed

- Risks to Monitor

- Solid Foundations for the New Year

Positive Start to the Year

It was a solid start to the new year for markets, with all three major U.S. equity indices starting the year in positive territory. The S&P 500 gained 1.68 percent in January while the Dow Jones Industrial Average (DJIA) was up 1.31 percent. The Nasdaq Composite lagged its peers slightly during the month, as the technology-heavy index gained 1.04 percent in January. While the market gains in January were smaller than those in December, this still marked three consecutive months with positive returns for all three indices.

The positive start to the year was supported by improving fundamentals. Per Bloomberg Intelligence as of January 31, with 37 percent of companies having reported actual earnings, the average earnings growth rate for the S&P 500 in the fourth quarter stood at 3.95 percent. This is well above analyst estimates at the start of earnings season for a more modest 1.18 percent increase. These better-than-expected results were widespread, as nine of the 11 sectors reported higher earnings growth than forecast. Over the long run fundamental factors drive market performance, so these positive results are a good sign for investors.

Technical factors were also supportive during the month. All three major U.S. indices ended January above their respective 200-day moving averages. This now marks three straight months with technical support for markets. The 200-day moving average is a widely monitored technical signal, as prolonged breaks above or below this level can signal shifting investor sentiment for an index. The mix of improving fundamentals and continued technical support is an encouraging backdrop for U.S. stocks to start the year.

The story was more mixed internationally. Developed markets held up reasonably well in January, as the MSCI EAFE Index gained 0.58 percent during the month. Emerging markets, though, struggled, with the index down 4.63 percent in January. The weakness in emerging markets was partially due to a continued sell-off in Chinese stocks, as the Shanghai Composite Index was down notably in January. Technical factors were also mixed for international markets in January. The MSCI EAFE Index managed to finish the month above its 200-day moving average for the third consecutive month. The MSCI Emerging Markets Index ended the month below trend after ending December above its 200-day moving average.

Mixed Month for Bonds

Fixed-income returns were also mixed during the month, as volatile interest rates weighed on bond prices. The 10-year Treasury rate started the month at 3.95 percent and rose as high as 4.18 percent during the month before falling and ending January at 3.99 percent. The Bloomberg Aggregate Bond Index lost 0.27 percent during the month.

High-yield bonds, which are typically less influenced by interest rates, ended January unchanged. The Bloomberg U.S. Corporate High Yield Bond Index gained 0.00 percent during the month. High-yield credit spreads fell from 3.54 percent at the start of January to 3.42 percent by the end of the month. Falling high-yield spreads indicate increased investor optimism and helped support high-yield bond returns to start the year.

Economic Growth Continues

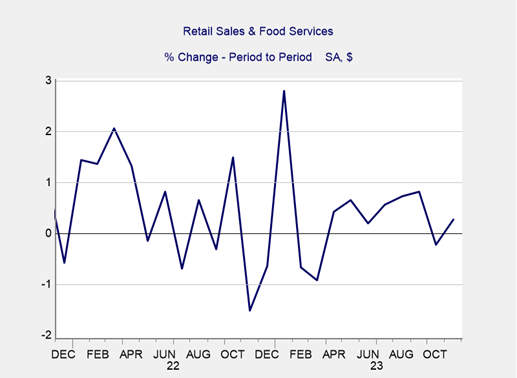

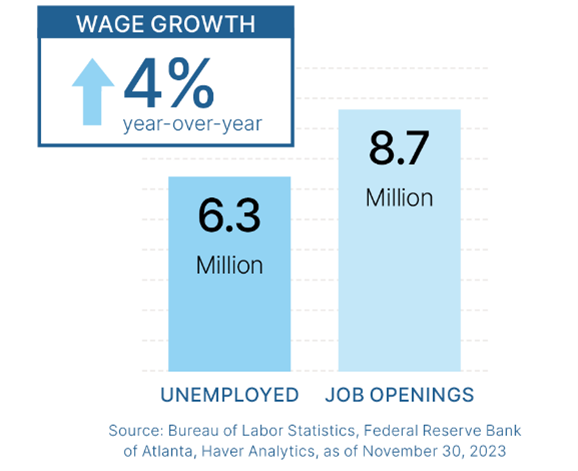

January’s economic updates showed continued signs of growth throughout the economy. This was highlighted by fourth-quarter GDP growth, which came in at a stronger-than-expected 3.3 percent on an annualized basis. This strong economic growth to end the year was supported by healthy job growth, as a better-than-expected 216,000 jobs were added in December. The unemployment rate ended the year at 3.8 percent, signaling continued demand for workers throughout the economy.

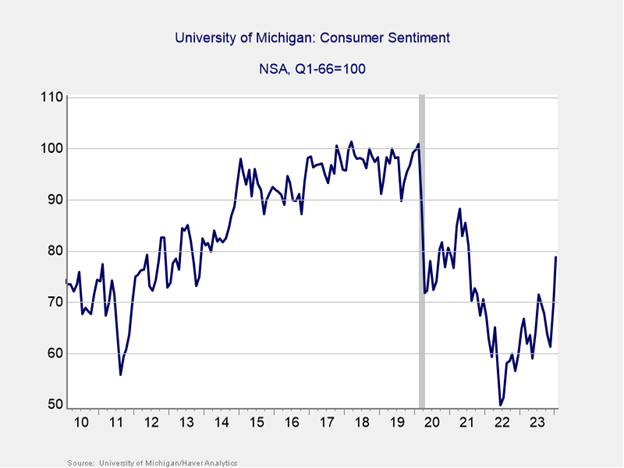

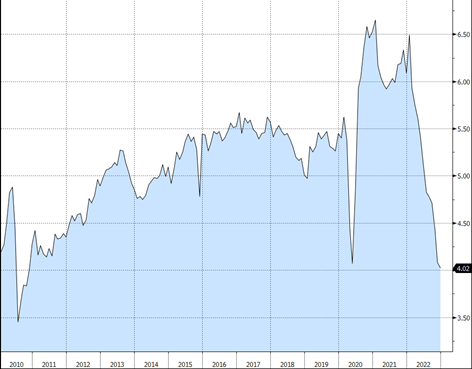

Consumer spending growth also remained strong in December. Retail sales and personal spending growth both improved during the month, with both measures of consumer spending coming in above economist estimates in December. Spending was supported by improved consumer sentiment to end the year, and we saw consumer sentiment increase even more to start January. As you can see in Figure 1, the University of Michigan Consumer Sentiment Index rose to its highest level in more than two years in January, supported by falling inflation expectations and an improved outlook on current economic conditions. Historically improved sentiment has supported faster spending growth, so this is a positive sign for consumer spending in 2024.

Figure 1: University of Michigan Consumer Sentiment, 2010-Present

Source: University of Michigan/Haver Analytics 1/19/2024

While the January economic updates largely pointed toward continued growth, they also contributed to still high levels of inflation. Headline consumer prices increased on a year-over-year basis in December, with year-over-year consumer price growth of 3.4 percent coming in above economist estimates for a more modest 3.2 percent increase. While other inflation metrics, such as core consumer prices and producer prices showed signs of softening inflation to end the year, the December inflation reports showed there is still real work to be done to get inflation back to the Federal Reserve’s (Fed’s) 2 percent target.

The Takeaway

– The economy continued to grow toward the end of last year, highlighted by strong job growth and better-than-expected fourth-quarter GDP growth.

– Improved consumer confidence should support spending and economic growth in the new year.

– Consumer inflation remained stubbornly high in December, signaling continued work needed to get price growth back to the Fed’s 2 percent target.

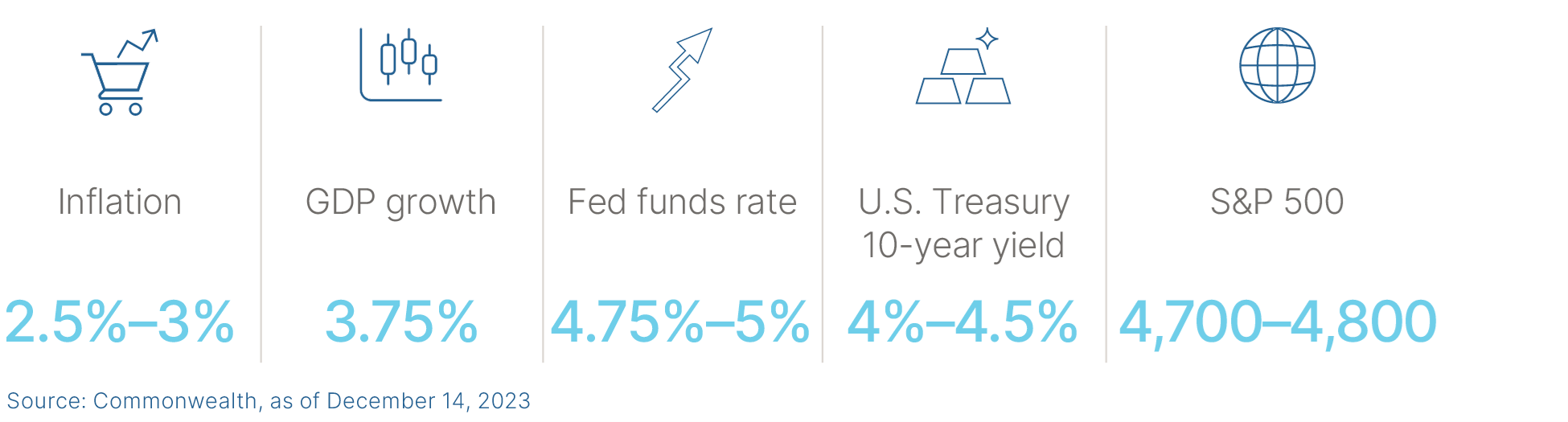

Update from the Fed

We ended the month with an update from the Fed, as the central bank’s first meeting of the year concluded on January 31. The Fed kept interest rates unchanged at this meeting as expected, but provided hints on the future path of interest rates. Fed chair Jerome Powell indicated in his post-meeting press conference that a rate cut at the Fed’s next meeting in March is unlikely, which was at odds with market projections. Markets ended the day down due in part to disappointed investors who were expecting further signs of a cut in March. This disconnect between market expectations and Fed policy contributed to the interest rate volatility that we saw throughout the month.

While markets still expect to see Fed cuts at some point this year, with futures pricing in a 25 basis point cut at the Fed’s May meeting, there is still uncertainty when it come to the timing of the Fed’s first cut. Going forward we’re likely to see short-term volatility surrounding the Fed and interest rates until we receive further clarity on the path forward for monetary policy.

Aside from the Fed, there are also external factors that could impact interest rates and therefore markets that should be monitored.

The Takeaway

– The Fed kept interest rate unchanged at the conclusion of its January meeting.

– Fed chair Jerome Powell indicated that a rate cut is unlikely at the Fed’s next meeting in March, disappointing some investors and contributing to a modest sell-off at month end.

Risks to Monitor

Domestically the major risks for markets remain inflation and the Fed, with the timing of the first rate cut serving as an example of the uncertainty coming from the central bank. Given the importance of the Fed and interest rates for markets, economists and investors will be keeping a close eye on any updates that may provide insight into the future path of monetary policy throughout the course of the year. Political risks remain as well given the election year, which has the potential to lead to increased uncertainty as the election date approaches.

Globally there are several risks to watch for as well. The rising tensions in the Middle East are worth noting, especially given new developments in the Red Sea that may further strain already frayed global supply chains. The ongoing conflict in Ukraine could also flare up at any time, creating the potential for further regional uncertainty. Finally, the continued slowdown in China could have negative impacts across the world given the country’s importance for global growth.

Ultimately there are present risks for markets that should be monitored. Additionally, we may face unforeseen risks throughout the course of the year that could lead to further uncertainty.

The Takeaway

– Real risks remain both domestically and abroad.

– Inflation and the Fed remain the major source of uncertainty for the U.S. with rising tensions in the Middle East serving as a source of international risk.

Solid Foundations for the New Year

Despite the real risks that markets and investors face, we remain in a good place after the first month of the year. The economic and market fundamentals remain sound, with solid economic growth and better than expected earnings growth supporting markets as we head into the new year.

Additionally, while there are real risks that markets face, they are nothing that we haven’t seen before. When it comes to inflation and the Fed we’re closer to the end than the beginning, with continued normalization expected in the months ahead.

While there is still uncertainty surrounding the timing of the Fed’s first cut in 2024, markets and economists expect to see a cut at some point this year, with most projections calling for a May cut. Looking at historical cutting cycles going back to 1982, equity markets tend to rally in the six months following a rate cut, so a cut in May would be a good sign for markets in the second half of the year.

After a very strong 2023, the economic and market momentum has carried into 2024, which should set the stage for another solid year for investors. That said, the potential for short-term setbacks remains. It’s important to remember that a well-diversified portfolio that aligns investor goals with timelines remains the best path forward for most. As always, you should reach out to your financial advisor to discuss your current plan if you have concerns.

Disclosure: This material is intended for informational/educational purposes only and should not be construed as investment advice, a solicitation, or a recommendation to buy or sell any security or investment product. Please contact your financial professional for more information specific to your situation.

Certain sections of this commentary contain forward-looking statements based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. Past performance is not indicative of future results. Diversification does not assure a profit or protect against loss in declining markets. All indices are unmanaged and investors cannot invest directly into an index. The Dow Jones Industrial Average is a price-weighted average of 30 actively traded blue-chip stocks. The S&P 500 Index is a broad-based measurement of changes in stock market conditions based on the average performance of 500 widely held common stocks. The Nasdaq Composite Index measures the performance of all issues listed in the Nasdaq Stock Market, except for rights, warrants, units, and convertible debentures. The MSCI EAFE Index is a float-adjusted market capitalization index designed to measure developed market equity performance, excluding the U.S. and Canada. The MSCI Emerging Markets Index is a market capitalization-weighted index composed of companies representative of the market structure of 26 emerging market countries in Europe, Latin America, and the Pacific Basin. It excludes closed markets and those shares in otherwise free markets that are not purchasable by foreigners. The Bloomberg Aggregate Bond Index is an unmanaged market value-weighted index representing securities that are SEC-registered, taxable, and dollar-denominated. It covers the U.S. investment-grade fixed-rate bond market, with index components for a combination of the Bloomberg government and corporate securities, mortgage-backed pass-through securities, and asset-backed securities. The Bloomberg U.S. Corporate High Yield Index covers the USD-denominated, non-investment-grade, fixed-rate, taxable corporate bond market. Securities are classified as high-yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below. One basis point (bp) is equal to 1/100th of 1 percent, or 0.01 percent.

Mark Gallagher is a financial advisor located at Gallagher Financial Services at 2586 East 7th Ave. Suite #304, North Saint Paul, MN 55109. He offers securities and advisory services as an Investment Adviser Representative of Commonwealth Financial Network®, Member FINRA/SIPC, a Registered Investment Adviser. He can be reached at 651-774-8759 or at mark@markgallagher.com

Authored by the Investment Research team at Commonwealth Financial Network.

© 2024 Commonwealth Financial Network