Presented by Mark Gallagher

Treats, not tricks, for markets

October was another good month for the economy and markets. Better-than-expected economic data in the U.S., combined with positive corporate earnings news, lifted the major market indices. The S&P 500 Index returned a solid 2.33 percent. The Nasdaq Composite had an even more impressive 3.61-percent return, while the Dow Jones Industrial Average led the way with a gain of 4.44 percent.

This positive performance was driven by improving fundamentals. According to FactSet, as of October 27, the third-quarter blended earnings growth rate for the S&P 500 was 4.7 percent. This was up from the 4.2 percent projected at the end of September. The improvement can be attributed to positive surprises in the technology and energy sectors. Although the growth rate is down from last quarter—due to the effects of the hurricanes on the insurance sector—10 of 11 sectors reported higher sales and 6 reported higher earnings. Fundamentals ultimately drive long-term performance, so this accelerating growth rate is a good sign. On the technical side, all three U.S. indices remained well above their 200-day moving averages for the month.

International equity markets also did well in October. The MSCI EAFE Index, which represents developed markets, rose by 1.52 percent. European economies have strengthened, driving improving earnings. In addition, an announcement near month-end from the European Central Bank suggested stimulus would continue, buoying results even more. Emerging markets fared better than developed markets in October. The MSCI Emerging Markets Index returned 3.51 percent on continued commodity and export strength. Both indices also looked good technically, remaining above their trend lines for the month.

Unlike the equity markets, fixed income had a more challenging month, as a slight uptick in rates weighed on performance. The Bloomberg Barclays U.S. Aggregate Bond Index gained a mere 0.06 percent. High-yield bonds did better, with Bloomberg Barclays U.S. Corporate High Yield Bond Index notching a 0.42-percent gain. Spreads for high-yield bonds remained compressed. Given the low global interest rate environment, these tight spread levels may persist for some time.

Positive economic surprises

October brought more treats on the economic front. Most major data releases beat expectations, pointing to accelerating growth. The first estimate of third-quarter gross domestic product (GDP) growth came in at 3 percent, beating expectations for a more modest 2.5-percent increase. The improvement was driven in large part by increases in business investment and net export growth. Both of these factors have been weak in recent quarters, so the broader base of economic growth is a positive change.

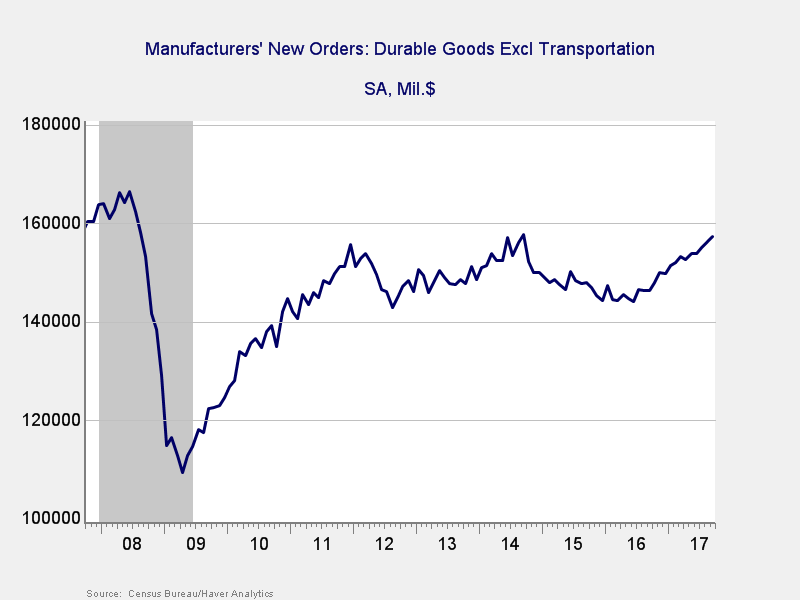

Previously reported improvements in business confidence and spending continued into October. Durable goods orders, which often are used as a proxy for long-term business investment, increased by more than twice the expected amount. Even better, core durable goods orders, which exclude volatile aircraft purchases, also beat expectations for the month. This measure now sits at its second-highest level since the recession, as shown in Figure 1.

Businesses continued to show surprisingly high levels of optimism, despite the recent hurricanes. Following last month’s unexpected jump to a 13-year high, the Institute for Supply Management’s Manufacturing Index drew back slightly. It remains at a high level, however. Given the weakening of the dollar so far this year and current high confidence levels, manufacturing growth is likely to drive faster overall economic growth in the fourth quarter.

Consumers and housing also outperform

Businesses weren’t the only drivers of economic growth last month; consumers joined in as well. Consumer sentiment continued to rise in October, with both major surveys at or close to their highest levels since the dot-com boom. These high confidence levels were matched by actual spending growth. Retail sales were at very healthy levels last month, even before adding in the rise in auto sales as owners replaced cars destroyed in the hurricanes.

Housing was also a bright spot. Homebuilder confidence rebounded with a large jump during the month. This was likely driven by very strong levels of demand for new housing, as both existing and new home sales beat expectations. New home sales came in at an impressive 667,000 versus expectations for 554,000. Although low supply remains a concern, and materials and labor shortages continue to constrain the industry, strong demand is apparently keeping activity and confidence high. This bodes well for the future.

Political risks diminish but can still spook markets

Overall, the news was good this month. Both the domestic and global economies appear to be in good shape, exhibiting solid fundamentals and the possibility of accelerating growth. Risks remain, of course, and they are largely political. Major domestic policies such as tax reform and the pending debt-ceiling vote have the potential to destabilize markets. Policy risks also remain, as we will see a change in leadership at the Federal Reserve, even as it considers faster rate increases. These factors, combined with high market valuation levels, can certainly contribute to increased volatility here in the U.S.

International politics also carries risks. Notably, in Spain, the confrontation between secessionist Catalans and the Spanish government could affect European markets. In addition, the ongoing negotiations around the British exit from the European Union are potentially heating up.

Outside of Europe, political risks have receded compared with last month. In Japan, key U.S. ally Prime Minister Shinzo Abe won a snap election and gained more seats in the legislature. Combined with the successful passing of the Chinese party meeting, this suggests more stability in the region. The situation in North Korea appears to have moderated as well, despite the ongoing rhetoric. The risks are still there, but things are actually calmer than they have been in some time.

Fundamentals remain solid but volatility likely

With a growing economy and solid corporate fundamentals, we can reasonably expect more good news ahead. That said, the real risks—both known and unknown—remain. The markets are calmer than they have been in decades, but we need to understand and be prepared for the return of market volatility at some point in the future.

For now, though, the global economy continues to do well—and markets ultimately respond to growth. A well-diversified portfolio, designed to take advantage of that growth, and matched with an investor’s time horizon, continues to offer the best path to reaching financial goals over the long term.

All information according to Bloomberg, unless stated otherwise.

Disclosure: Certain sections of this commentary contain forward-looking statements based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. Past performance is not indicative of future results. Diversification does not assure a profit or protect against loss in declining markets. All indices are unmanaged and investors cannot invest directly into an index. The Dow Jones Industrial Average is a price-weighted average of 30 actively traded blue-chip stocks. The S&P 500 Index is a broad-based measurement of changes in stock market conditions based on the average performance of 500 widely held common stocks. The Nasdaq Composite Index measures the performance of all issues listed in the Nasdaq Stock Market, except for rights, warrants, units, and convertible debentures. The MSCI EAFE Index is a float-adjusted market capitalization index designed to measure developed market equity performance, excluding the U.S. and Canada. The MSCI Emerging Markets Index is a market capitalization-weighted index composed of companies representative of the market structure of 26 emerging market countries in Europe, Latin America, and the Pacific Basin. It excludes closed markets and those shares in otherwise free markets that are not purchasable by foreigners. The Bloomberg Barclays U.S. Aggregate Bond Index is an unmanaged market value-weighted index representing securities that are SEC-registered, taxable, and dollar-denominated. It covers the U.S. investment-grade fixed-rate bond market, with index components for a combination of the Bloomberg Barclays government and corporate securities, mortgage-backed pass-through securities, and asset-backed securities. The Bloomberg Barclays U.S. Corporate High Yield Index covers the USD-denominated, non-investment-grade, fixed-rate, taxable corporate bond market. Securities are classified as high-yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below.

Mark Gallagher is a financial advisor located at Gallagher Financial Services at 2586 East 7th Ave. Suite #304, North Saint Paul, MN 55109. He offers securities and advisory services as an Investment Adviser Representative of Commonwealth Financial Network®, Member FINRA/SIPC, a Registered Investment Adviser. He can be reached at 651-774-8759 or at mark@markgallagher.com.

Authored by Brad McMillan, senior vice president, chief investment officer, and Sam Millette, fixed income analyst, at Commonwealth Financial Network®.

© 2017 Commonwealth Financial Network®