Presented by Mark Gallagher

A disappointing year for financial markets

U.S. markets posted weak results for December and 2015 as a whole, despite solid fourth-quarter gains. The Dow Jones Industrial Average, S&P 500 Index, and Nasdaq were all down in December—1.52 percent, 1.58 percent, and 1.98 percent, respectively. But all were up strongly for the quarter, with the Dow rising 7.70 percent, the S&P 500 gaining 7.04 percent, and the Nasdaq up a robust 8.38 percent.

For the year, the Dow was up 0.21 percent and the S&P 500 gained 1.38 percent. Although the Nasdaq was up 5.73 percent for the year, this result was well below average annual return levels.

International markets underperformed U.S. markets in 2015. The MSCI EAFE Index, which represents developed international markets, was down 1.35 percent for December but up 4.71 percent for the quarter. The MSCI Emerging Markets Index fared worse, down 2.48 percent for December and posting a marginal 0.26-percent quarterly gain. For the year as a whole, developed and emerging markets were down 0.81 percent and 16.96 percent, respectively. In addition, both indices ended the year well below their 200-day moving averages.

Fixed income had a relatively weak 2015. The Barclays Capital U.S. Aggregate Bond Index was down 0.32 percent for December and 0.57 percent for the fourth quarter, which resulted in a gain of only 0.55 percent for the year as a whole. This tepid performance was largely driven by volatility in interest rates throughout 2015.

Economic recovery continues slow but steady

The major economic story for the fourth quarter was the Federal Reserve’s decision to raise target interest rates, signaling that the economy was strong enough to accommodate a move toward normal interest rates.

The service sector—which constitutes roughly seven-eighths of the economy—performed strongly, generating substantial improvement in employment. More than 2.6 million jobs were created in 2015.

At year-end, slow wage growth showed signs of improvement. Although consumer spending growth was slower than wage income growth, savings rates approached previous high levels, suggesting that spending could accelerate.

Low oil prices support continued growth

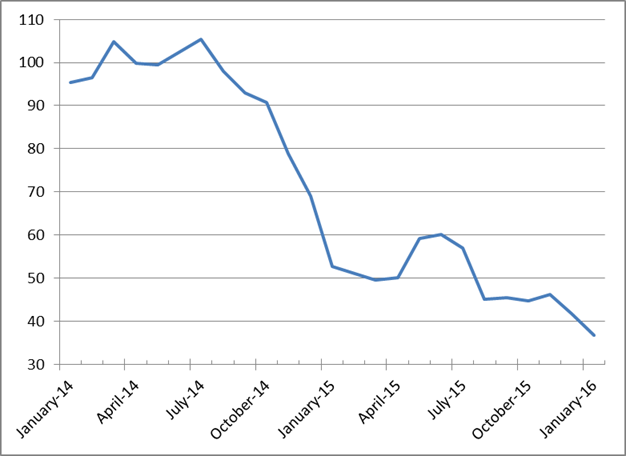

Most observers had expected oil prices to rebound in 2015, but they remained low. After declining 50 percent from their 2014 peak, prices stabilized in mid-2015 at $55 to $60 per barrel, only to drop in the second half of the year to below $40 per barrel. This volatility is clearly seen in Figure 1.

Figure 1. WTI Crude Spot Prices, January 2014–January 2016

Source: Bloomberg

We have no direct evidence of increased consumer spending as a result of lower gas prices, but the fact that auto sales rose to more than 18 million vehicles in 2015 suggests that there has been a positive effect. Lower energy prices also benefit companies, in the form of lower costs, which helps profit margins and potentially stock prices.

Looking ahead, even though the previous oil price decline has worked its way into the economy, most of the more recent decline has not, suggesting that economic growth may continue to accelerate. Lower oil prices will also benefit other countries, especially China, Europe, and Japan. These economies continue to stagnate, and lower energy costs will act as a much-needed stimulus.

U.S. outlook remains good, but there are risks

We begin 2016 with a positive outlook; however, risks remain. China’s growth continues to decline, and Europe and Japan are at risk economically. In the case of Europe, the risks are also political because of the Syrian refugee crisis. Perhaps most worrisome is the Middle East, where ISIS is expanding.

Here in the U.S., there are signs of a slowdown. Corporate fundamentals may be weakening, though stock valuations remain high. Expected earnings growth has been downgraded for 2016, and further downgrades are possible.

These risks notwithstanding, the U.S. economy is solid, trends are good, and we are well positioned to overcome challenges. As always, a long-term perspective and diversified portfolio are the best ways to take advantage of opportunities and overcome risks.

All information according to Bloomberg, unless stated otherwise.

Disclosure: Certain sections of this commentary contain forward-looking statements that are based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. Past performance is not indicative of future results. Diversification does not assure a profit or protect against loss in declining markets. All indices are unmanaged and investors cannot invest directly into an index. The Dow Jones Industrial Average is a price-weighted average of 30 actively traded blue-chip stocks. The S&P 500 Index is a broad-based measurement of changes in stock market conditions based on the average performance of 500 widely held common stocks. The Nasdaq Composite Index measures the performance of all issues listed in the Nasdaq Stock Market, except for rights, warrants, units, and convertible debentures. The MSCI EAFE Index is a float-adjusted market capitalization index designed to measure developed market equity performance, excluding the U.S. and Canada. The MSCI Emerging Markets Index is a market capitalization-weighted index composed of companies representative of the market structure of 26 emerging market countries in Europe, Latin America, and the Pacific Basin. It excludes closed markets and those shares in otherwise free markets that are not purchasable by foreigners. The Barclays Capital Aggregate Bond Index is an unmanaged market value-weighted index representing securities that are SEC-registered, taxable, and dollar-denominated. It covers the U.S. investment-grade fixed-rate bond market, with index components for a combination of the Barclays Capital government and corporate securities, mortgage-backed pass-through securities, and asset-backed securities.

Authored by Brad McMillan, senior vice president, chief investment officer, at Commonwealth Financial Network.

© 2016 Commonwealth Financial Network®