Presented by Mark Gallagher

More treats than tricks for markets in October

October was another positive month for markets. Diminishing risks helped drive equity markets near all-time highs. The S&P 500 gained 2.17 percent in October and finished the month at a new record high. The Dow Jones Industrial Average grew by 0.59 percent in October, while the Nasdaq Composite led the way with a 3.71 percent return.

These positive results were supported by better-than-expected earnings during the month. According to Bloomberg Intelligence, the anticipated third-quarter earnings decline for the S&P 500 is 2.1 percent, with 60 percent of companies reporting as of October 31. This is up from estimates of a 3.2 percent decline at the end of September. Further, improvements are widespread, with 8 of the 11 sectors performing better than expected. Fundamentals drive long-term market performance, so this improving third-quarter earnings picture is encouraging. Technicals were also supportive for U.S. markets. All three major indices spent the month above their respective 200-day moving averages, despite some early volatility.

Results were also strong internationally, as receding risk of a “no deal” Brexit buoyed markets. The MSCI EAFE Index increased by a strong 3.59 percent during the month. Emerging markets fared even better, as the MSCI Emerging Markets index climbed 4.23 percent. Technical factors were mixed, however. The MSCI EAFE spent the beginning of October below its 200-day moving average before breaking above the trend line for the rest of the month. Emerging markets took longer to break above the trend but managed to finish the month above this important technical level for the first time since July.

Even fixed income had a solid month, as the Federal Reserve (Fed) cut the federal funds rate by 25 basis points at its October meeting. This marks the third straight meeting where the Fed has cut interest rates, as concerns surrounding lackluster job growth and slowing global trade continue to weigh on board members’ minds. Interest rates rose slightly on the long end of the curve. The 10-year Treasury yield started the month at 1.65 percent and ended at 1.69 percent. The Bloomberg Barclays U.S. Aggregate Bond Index increased by 0.30 percent during the month, and the Bloomberg Barclays U.S. Corporate High Yield Index gained 0.28 percent.

Economic data points to slower growth

The positive returns we saw in October came despite recent data releases that painted a picture of slower overall growth. Annualized third-quarter gross domestic product growth came in at 1.9 percent. This result was down from the 2 percent growth seen in the second quarter and the 3.1 percent growth seen in the first quarter. While slowing overall growth is disappointing, economists had forecast a larger drop to 1.6 percent, so there is some reason for optimism here. This result was driven by stronger-than-expected consumer spending, which offset a slowdown in government spending and business investment.

Consumer spending will likely be the major driver of economic growth in the fourth quarter, as business confidence and spending continue to disappoint. Manufacturer confidence has declined sharply throughout the year, hitting a 10-year low in September. We also saw a decline in the nonmanufacturing sector, which accounts for the lion’s share of economic output. After rebounding in August, the Institute for Supply Management (ISM) Nonmanufacturing index fell to 52.6 in September. The ISM composite index, which aggregates the manufacturing and nonmanufacturing indices, has fallen sharply since reaching a high point in September 2018, as uncertainty from trade wars and various political developments have weighed on business-owner confidence.

Figure 1. ISM Composite Index, 2009–Present

With business confidence declining, it’s no surprise that spending was lackluster as well. Durable goods orders fell by 1.1 percent in September, against expectations for a more moderate decline of 0.7 percent. Industrial production fell 0.4 percent, and manufacturing output fell 0.5 percent. The General Motors strike may be to blame for some of this decline. But the overall trend points toward continued weakness in business confidence and spending for the immediate future.

Consumer confidence rebounds as spending continues

With markets near or at all-time highs and the unemployment rate near a 50-year low, it is not surprising consumer confidence rebounded in October. The University of Michigan consumer sentiment index increased from 93.2 in September to 95.5 in October. Overall, things are going pretty well for consumers, and higher confidence levels should help drive continued spending growth.

In fact, consumer spending increased by 0.2 percent in September, marking the seventh straight month of growth. This result was supported by a 0.3 percent increase in personal income, which has grown in each of the past 12 months. Solid income growth indicates that the personal spending growth we have experienced this year is sustainable.

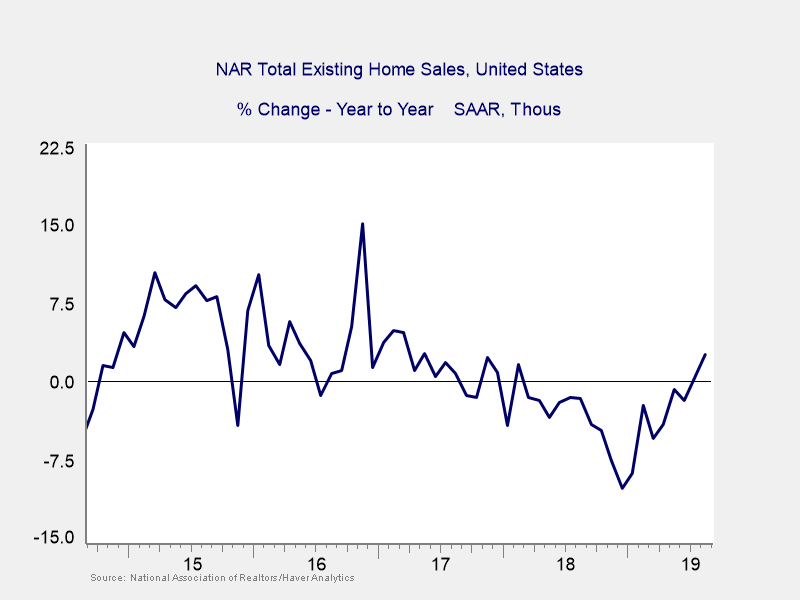

The housing sector, likewise, has shown positive momentum following a weak start to the year. Existing home sales fell slightly in September. On a year-over-year basis, however, they rose by a healthy 3.9 percent. We have seen year-over-year growth in housing sales for the past 3 months, following 16 straight months of year-over-year declines. The continued growth in housing is encouraging given the effect it can have on other sectors of the economy. And while high consumer confidence and strong balance sheets are certainly factors in this housing turnaround, the Fed deserves some credit too. Mortgage rates have dropped near two-year lows, as the central bank continues to cut rates and support the ongoing economic expansion.

Political risks shift in October

We entered October with concerns about the escalating trade war between the U.S. and China, as well as the risk of a “no-deal” Brexit. Both of these risks receded during the month, however. Plans for a preliminary U.S.-China trade deal are now on the table, and another extension of the Brexit deadline was announced, this time to January 31, 2020. Markets reacted favorably to these receding risks, but new concerns have emerged to take their place.

Domestically, the impeachment inquiry highlights the very real risk impeachment presents to markets. With public hearings set to begin this month, growing uncertainty may cause volatility. Earlier in the month, a surprise withdrawal of U.S. troops from portions of Syria also seized headlines. Markets quickly shrugged off this development, however.

Internationally, new risks have emerged as well. The British elections are now set for mid-December, as the U.K. and the European Union continue to hammer out a Brexit deal. And if trade war tensions ratchet back up or the protests in Hong Kong increase in intensity, we may see additional market volatility.

Short-term risks remain, but fundamentals are solid

Despite politically driven uncertainty, economic fundamentals remain solid in the U.S. While growth appears to be slowing from earlier in the year, slower growth is still growth. Rebounding consumer confidence and continued strong consumer spending indicate the economy is in a better place than the headlines suggest. If business confidence and spending can follow suit, the economy would be poised for accelerated growth.

There are still very real risks out there, however—the ongoing impeachment inquiry in particular. While short-term volatility may be likely given the political risks, the strong fundamentals should continue to support markets. As always, a well-diversified portfolio that matches investors’ goals can provide the best path forward in these uncertain times.

All information according to Bloomberg, unless stated otherwise.

Disclosure: Certain sections of this commentary contain forward-looking statements based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. Past performance is not indicative of future results. Diversification does not assure a profit or protect against loss in declining markets. All indices are unmanaged and investors cannot invest directly into an index. The Dow Jones Industrial Average is a price-weighted average of 30 actively traded blue-chip stocks. The S&P 500 Index is a broad-based measurement of changes in stock market conditions based on the average performance of 500 widely held common stocks. The Nasdaq Composite Index measures the performance of all issues listed in the Nasdaq Stock Market, except for rights, warrants, units, and convertible debentures. The MSCI EAFE Index is a float-adjusted market capitalization index designed to measure developed market equity performance, excluding the U.S. and Canada. The MSCI Emerging Markets Index is a market capitalization-weighted index composed of companies representative of the market structure of 26 emerging market countries in Europe, Latin America, and the Pacific Basin. It excludes closed markets and those shares in otherwise free markets that are not purchasable by foreigners. The Bloomberg Barclays Aggregate Bond Index is an unmanaged market value-weighted index representing securities that are SEC-registered, taxable, and dollar-denominated. It covers the U.S. investment-grade fixed-rate bond market, with index components for a combination of the Bloomberg Barclays government and corporate securities, mortgage-backed pass-through securities, and asset-backed securities. The Bloomberg Barclays U.S. Corporate High Yield Index covers the USD-denominated, non-investment-grade, fixed-rate, taxable corporate bond market. Securities are classified as high-yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below.

Mark Gallagher is a financial advisor located at Gallagher Financial Services at 2586 East 7th Ave. Suite #304, North Saint Paul, MN 55109. He offers securities and advisory services as an Investment Adviser Representative of Commonwealth Financial Network®, Member FINRA/SIPC, a Registered Investment Adviser. He can be reached at 651-774-8759 or at mark@markgallagher.com.

Authored by Brad McMillan, CFA®, CAIA, MAI, managing principal, chief investment officer, and Sam Millette, senior investment research analyst, at Commonwealth Financial Network®.

© 2019 Commonwealth Financial Network ®