Presented by Mark Gallagher

A strong end to a weak month

U.S. financial markets ended strongly in May, as economic reports improved and the Federal Reserve (Fed) suggested that the economy had healed enough for it to start raising rates. After dropping between 1 percent and 2 percent mid-month, stocks rallied at month-end. All major U.S. equity markets posted gains, with the Dow Jones Industrial Average up 0.49 percent, the S&P 500 Index up even more at 1.80 percent, and the Nasdaq doing better yet, increasing a surprising 3.62 percent.

The good performance in May was driven by unexpectedly positive corporate earnings news. Although down 6.7 percent, first-quarter earnings declined less than the 8.8-percent drop expected. Moreover, for first-quarter earnings reported by the end of May, seven of ten sectors had posted higher growth rates; this, too, was a consequence of positive earnings surprises.

Despite the less-than-stellar overall earnings results, many companies did do well. Almost three-quarters of companies, 72 percent, beat earnings expectations, which was above the average percentage of beats in past quarters. In addition, six of ten sectors showed revenue growth and four of ten sectors showed earnings growth. While results for the first quarter of 2016 were weak, conditions improved substantially—especially looking forward to the rest of the year—and the market reacted accordingly.

Technical factors remained supportive for U.S. markets. All three major indices finished May well above their 200-day moving averages, with the Nasdaq making that technical leap toward month-end, improving on its results for April.

Developed international markets didn’t fare as well as their U.S. counterparts, experiencing a similar pullback during the month but a smaller rally at month’s end. Even though the MSCI EAFE Index was down about 2 percent in mid-May, it finished the period with only a 0.91-percent loss. Just as with U.S. markets, the catalyst for the EAFE rally was improving economic and company news. This was offset, however, by continued political worries in Europe and disappointing news from Japan. Nevertheless, technical factors for the index improved, and it closed slightly above its 200-day moving average, suggesting that fundamental market trends may be getting better.

Emerging markets, as reflected in the MSCI Emerging Markets Index, were hit even harder than developed markets but managed to recover from a 7-percent loss mid-month to drop “only” 3.71 percent at month-end. Continued concerns about an expensive dollar and its effect on emerging markets, exacerbated by worries about a potential Fed rate increase, drove markets down. Here the technical picture was also better, as the index did move slightly back above its 200-day moving average.

Broad fixed income markets also had a weak May, with the Barclays Capital Aggregate Bond Index reporting a small 0.03-percent gain. U.S. Treasury rates dropped slightly, helping the performance of U.S. government debt, but the release of hawkish Federal Open Market Committee (FOMC) minutes increased volatility during the month. High-yield, as represented by the Barclays Capital U.S. Corporate High Yield Index, performed well, rising 0.62 percent.

Another weak first quarter for the U.S. economy, but signs of spring

The gross domestic product (GDP) report, released at month-end, showed that the U.S. economy had grown marginally faster, 0.8 percent, in the first quarter of 2016 than the 0.5-percent uptick initially estimated. This was consistent with the experience of the last two years, where a weak first quarter was followed by faster growth. In line with that, May’s economic data was mixed. Overall, however, the month’s numbers suggested that growth should increase substantially going forward.

Weak data came from manufacturing and capital investment, with the ISM Manufacturing survey indicators still hovering between expansion and contraction. In addition, orders for durable goods and capital equipment continued to run below expectations and are either flat or down over the previous 12 months. The effects of the strong dollar and low oil prices on the U.S. industrial economy linger, and even though those headwinds are fading, we have not yet seen significant improvement.

Offsetting this is substantial improvement in the service sector and consumer demand, which each constitute a much larger share of the economy. The ISM Nonmanufacturing survey rose more than expected, and the most forward-looking component, the new orders index, hit a six-month high. At seven-eighths of the economy, the service sector matters.

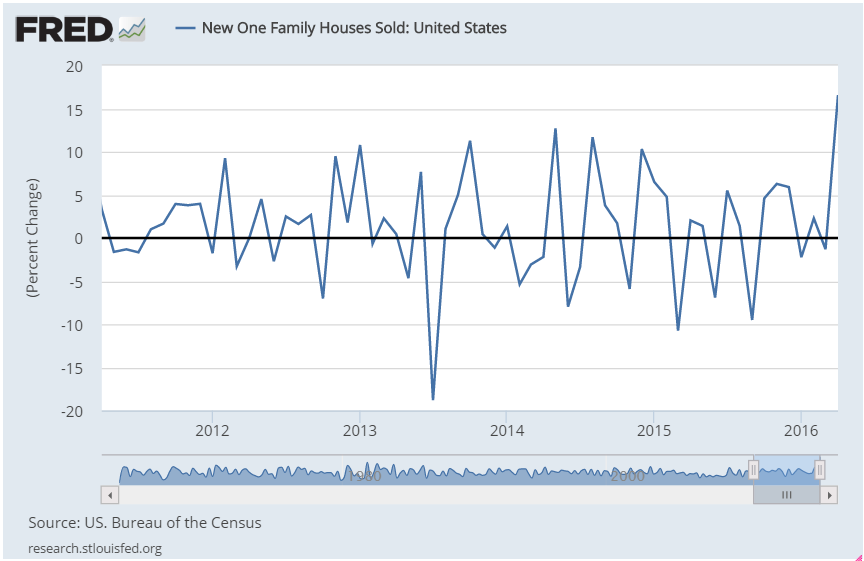

Similarly, in April, as announced in May, consumer spending rose by the most in two years, with upward revisions to previous months also reported. Consumer spending represents two-thirds of the economy, so faster growth should lift overall growth in the second quarter. Housing sales also surprised to the upside across the board, with new home sales particularly strong, as illustrated in Figure 1.

Figure 1. New Single-Family House Sales, Monthly Percentage Change,

2012–Year-to-Date 2016

The growth in consumer spending was driven by continued expansion in the employment arena. Although job growth ticked down in April, to 160,000, the average hours worked rose, resulting in an increase in overall labor demand. Wage growth also continued, rising to 2.5 percent over the past year.

Given the mix of generally positive fundamentals and the growing consumer willingness to spend, economic growth is likely to accelerate in the second quarter. Forecasts for GDP growth now range up to 2.9 percent—and possibly higher. Though this estimate may be too optimistic, signs of spring are definitely visible, and faster sustainable growth becomes increasingly likely in the second half of the year.

Central banks and interest rates

As previously noted, even the Fed is starting to believe that the economy is healing. After years of discouraging FOMC meeting minutes, the most recent release came as a surprise, commenting that the economy was considered to be at full employment and inflation was considered to be moving in the right direction. This unanticipated positive view was accompanied by a clear statement that rate increases were quite possible this year and could come earlier than expected—maybe as soon as the end of June.

The implications of the FOMC statements are positive for the economy but mixed for markets, as higher interest rates might act as a headwind going forward. With that said, continued stimulus by foreign central banks is likely to constrain rate increases. Consequently, the combination of Fed confidence in the economy and continued low rates suggests that interest rates will remain supportive of the economy for at least the next couple of months, which should also help to sustain economic growth.

International risk remains

Although conditions in the U.S. are improving, at the international level risks remain. Europe is the focus for the moment. The most immediate risk is the June 23 referendum in the United Kingdom regarding whether Britain should leave the European Union (EU). The success of the anti-EU parties in demanding such a referendum there could encourage this possibility in other countries. Should the referendum pass—and polls indicate that it is possible though not likely—significant market turbulence is possible.

Another concern in Europe is the return to center stage of negotiations over Greek debt. With the International Monetary Fund and Germany at odds again, and with Greece possibly unable to comply with EU fiscal requirements, expect more headlines. Nevertheless, even if Greece were to default, systemic risk is much lower now than in the past, though uncertainty may still rattle markets.

The other major international risk is China. Growth continues to disappoint, and China’s government continues to increase stimulus. At the same time, concerns are increasing again about China’s ability to manage its economy and, especially, its currency. Perhaps in response to domestic concerns, China has become much more aggressive with respect to other countries, expanding its installations in what the U.S., for one, considers international waters in the South China Sea. This will continue to raise political concerns in addition to very real economic ones.

U.S. economic growth continues and on a sustainable basis

With the U.S. economy on the mend and the bulk of the risk coming from international issues, we seem to be returning to normal. We are not quite there yet, but we are indeed getting closer.

Normal does not mean, however, that risks have vanished; they have simply changed. With the Fed getting closer to raising rates, the risks associated with those higher rates are garnering more attention. In addition, the previously mentioned British referendum and Greek debt woes represent immediate risks. Moreover, the risk associated with China’s slowing growth, though less immediate, is potentially just as real a concern. Finally, although the U.S. recovery is expected to continue and even accelerate, that is neither guaranteed nor something that will go on forever.

Cautious optimism remains the appropriate outlook for investors. As always, maintaining a big-picture perspective and diversified portfolio is the best way to meet financial goals. Enjoy the current improvements but stay focused on the long-term horizon rather than on intermediate events—good or bad.

All information according to Bloomberg, unless stated otherwise.

Disclosure: Certain sections of this commentary contain forward-looking statements that are based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. Past performance is not indicative of future results. Diversification does not assure a profit or protect against loss in declining markets. All indices are unmanaged and investors cannot invest directly into an index. The Dow Jones Industrial Average is a price-weighted average of 30 actively traded blue-chip stocks. The S&P 500 Index is a broad-based measurement of changes in stock market conditions based on the average performance of 500 widely held common stocks. The Nasdaq Composite Index measures the performance of all issues listed in the Nasdaq Stock Market, except for rights, warrants, units, and convertible debentures. The MSCI EAFE Index is a float-adjusted market capitalization index designed to measure developed market equity performance, excluding the U.S. and Canada. The MSCI Emerging Markets Index is a market capitalization-weighted index composed of companies representative of the market structure of 26 emerging market countries in Europe, Latin America, and the Pacific Basin. It excludes closed markets and those shares in otherwise free markets that are not purchasable by foreigners. The Barclays Capital Aggregate Bond Index is an unmanaged market value-weighted index representing securities that are SEC-registered, taxable, and dollar-denominated. It covers the U.S. investment-grade fixed-rate bond market, with index components for a combination of the Barclays Capital government and corporate securities, mortgage-backed pass-through securities, and asset-backed securities. The Barclays Capital U.S. Corporate High Yield Index covers the USD-denominated, non-investment-grade, fixed-rate, taxable corporate bond market. Securities are classified as high-yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below.

Mark Gallagher is a financial advisor located at Gallagher Financial Services at 2586 East 7th Ave. Suite #304, North Saint Paul, MN 55109. He offers securities and advisory services as an Investment Adviser Representative of Commonwealth Financial Network®, Member FINRA/SIPC, a Registered Investment Adviser. He can be reached at 651-774-8759 or at mark@markgallagher.com

Authored by Brad McMillan, senior vice president, chief investment officer, at Commonwealth Financial Network.

© 2016 Commonwealth Financial Networ