Presented by Mark Gallagher

Markets drop around the world

January was a terrible month for markets around the world. U.S. markets had their worst January since 2009, with all three major indices posting declines. The Dow Jones Industrial Average was down 5.39 percent, the S&P 500 Index declined 4.96 percent, and the Nasdaq dropped 7.82 percent. All three indices are now well below their 200-day moving averages.

A loss of confidence was the primary reason for the downturn. Market turbulence in China rattled investors, as the Federal Reserve’s (Fed’s) rate increase started to remove their security blanket. Fundamentals also weighed in. A further substantial drop in oil prices eroded that industry’s revenue and profit prospects. Moreover, corporate earnings for fourth-quarter 2015 were expected to decline 5.8 percent. Declining earnings made it difficult to justify the relatively high stock valuations that had prevailed at the start of 2016.

International markets had a worse January than U.S. markets. The MSCI EAFE Index of developed markets dropped 7.23 percent, and the MSCI Emerging Markets Index declined 6.48 percent. Technically, both indices are well below their 200-day moving averages.

Fixed income did well. The Barclays Capital Aggregate Bond Index gained 1.38 percent for the month.

U.S. economy grows, though more slowly

U.S. gross domestic product (GDP) growth for fourth-quarter 2015, reported in January, was 0.7 percent, down from the previous quarter’s 2 percent. The decline was due largely to weakness in U.S. manufacturing and exports, held in check by the strong dollar.

Consumer spending growth also declined in the fourth quarter, though consumer confidence remained strong and savings rates increased. These trends continued into January.

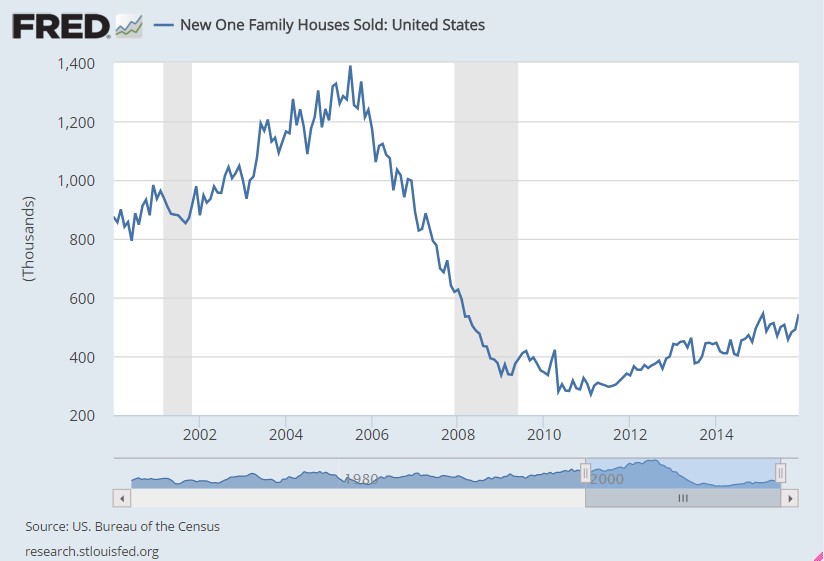

Positive economic signs included a strong jobs picture and rising wage growth. The housing market also grew strongly, with December new home sales surprising to the upside. This factor appears to offer the prospect of further growth, as new home sales remain below historical levels and therefore could have room to improve (see Figure 1).

International problems multiply

Much of the slowdown in U.S. GDP appears to have stemmed from problems in the rest of the world. Substantial declines in China’s stock markets forced concerns about that nation’s financial system and slowing economy to the forefront of world attention. Although the People’s Bank of China continues to drive stimulus, there are signs that the bank’s ability to affect the economy is waning.

Europe also continues to struggle. The European Central Bank is still pursuing stimulus policies, but eurozone political concerns may negatively affect growth.

Finally, at month-end, Japan announced negative interest rates. This is widely considered a radical move and one that Japan’s central bank took only because all other measures had not succeeded.

The Fed starts to raise interest rates

Despite global economic problems, the Fed felt confident enough in the U.S. economy to raise interest rates. But this move exacerbated other concerns, notably about the future strength of the dollar.

The strong dollar has made U.S. manufacturers less competitive abroad and has been a significant headwind for the overall U.S. economy. With other central banks easing monetary policy and the Fed starting to tighten U.S. monetary policy, the divergence could drive the dollar higher. If so, the headwinds for the U.S. economy could strengthen. With this and other factors in play, the Fed could decide to raise rates more slowly than it now projects.

Rising risks mean nervous markets

January’s stock market declines reflect this risky environment. Nevertheless, though risks abound, there are opportunities. U.S. growth continues, and forward-looking indicators suggest that it may accelerate. Moreover, the perceptions of risk seem excessive.

Consequently, although it has been a difficult month, investors should remain calm. January’s events underscore the need for maintaining a diversified portfolio and a long-term perspective. Cautious optimism remains the appropriate stance, as history has shown that markets and economies consistently return to a growth path.

All information according to Bloomberg, unless stated otherwise.

Disclosure: Certain sections of this commentary contain forward-looking statements that are based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. Past performance is not indicative of future results. Diversification does not assure a profit or protect against loss in declining markets. All indices are unmanaged and investors cannot invest directly into an index. The Dow Jones Industrial Average is a price-weighted average of 30 actively traded blue-chip stocks. The S&P 500 Index is a broad-based measurement of changes in stock market conditions based on the average performance of 500 widely held common stocks. The Nasdaq Composite Index measures the performance of all issues listed in the Nasdaq Stock Market, except for rights, warrants, units, and convertible debentures. The MSCI EAFE Index is a float-adjusted market capitalization index designed to measure developed market equity performance, excluding the U.S. and Canada. The MSCI Emerging Markets Index is a market capitalization-weighted index composed of companies representative of the market structure of 26 emerging market countries in Europe, Latin America, and the Pacific Basin. It excludes closed markets and those shares in otherwise free markets that are not purchasable by foreigners. The Barclays Capital Aggregate Bond Index is an unmanaged market value-weighted index representing securities that are SEC-registered, taxable, and dollar-denominated. It covers the U.S. investment-grade fixed-rate bond market, with index components for a combination of the Barclays Capital government and corporate securities, mortgage-backed pass-through securities, and asset-backed securities.

###

Mark Gallagher is a financial advisor located at Gallagher Financial Services at 2586 East 7th Ave #304, North Saint Paul, MN 55109. He offers securities and advisory services as an Investment Adviser Representative of Commonwealth Financial Network®, Member FINRA/SIPC, a Registered Investment Adviser. He can be reached at 651-774-8759 or at mark@markgallagfher.com.

Authored by Brad McMillan, senior vice president, chief investment officer, at Commonwealth Financial Network.

© 2016 Commonwealth Financial Network®