Presented by Mark Gallagher

Markets Slide in February

Markets sold off in February, driven first by continued concerns about inflation and then by the Russian invasion of Ukraine. The S&P 500 dropped 2.99 percent while the Dow Jones Industrial Average was down 3.29 percent. The Nasdaq Composite Index was hit the hardest and its heavy weighting toward technology companies led to a 3.35 percent decline. This result marks two consecutive months with losses to start the year for all three indices.

Despite the selloff during the month, fundamentals showed continued improvement. According to Bloomberg Intelligence, as of February 25, with 95 percent of companies having reported actual fourth-quarter earnings, the average earnings growth rate for the S&P 500 was 28.5 percent. This is up notably from estimates for a 19.8 percent increase at the start of earnings season and shows that businesses continued to operate successfully despite rising medical risks. Since fundamentals drive market performance, the better-than-expected results in earnings is an encouraging sign for U.S. companies and markets.

Volatility turned technical factors for equities negative in February. All three major U.S. indices finished well below their respective 200-day moving averages, marking the first time all three indices have finished a month below trend since March 2020. The 200-day moving average is an important technical indicator, as prolonged breaks above or below this level can signal shifting investor sentiment for an index. This will be an important area to monitor to determine if investor sentiment has soured on U.S. markets or if the recent declines were a temporary market reaction to the rising risks to start the year.

The story was much the same internationally, with rising geopolitical risks taking center stage toward month-end. The MSCI EAFE Index declined 1.77 percent and emerging markets were hit even harder, with the MSCI Emerging Markets Index down 2.98 percent. Technicals were challenging for international markets as well. The indices ended below their respective 200-day moving averages, marking the second consecutive month where both finished below trend and eight consecutive months below trend for the MSCI Emerging Markets Index.

Even fixed income markets were down last month; however, this was primarily due to a mid-month rise in rates that was largely erased by month-end. The 10-year U.S. Treasury yield started at 1.81 percent, reached a high of 2.05 percent on February 15, and finished at 1.83 percent. The rate increase was largely a result of concerns regarding inflation and the Federal Reserve (Fed)’s anticipated rate hike in March, while the subsequent decline was driven by a flight to quality trade due to the Russian invasion. The Bloomberg U.S. Aggregate Bond Index ended down 1.12 percent.

High-yield fixed income, which is typically less driven by changes in interest rates and moves more in line with equities, also had a tough February. The Bloomberg U.S. High Yield Corporate Index dropped 1.03 percent. High-yield credit spreads widened to their highest month-end level since January 2021, indicating rising investor concern and demand for additional yield to invest in these riskier securities.

Risks Shift Throughout the Month

February saw rapid changes in the risks driving markets. Early on, declining medical risks helped support an equity market rebound following declines in January. At mid-month, though, concerns about inflation and the Fed’s plans for tighter monetary policy took center stage and rattled markets before the Russian invasion at month-end added more uncertainty.

We saw a significant decline in daily new Covid-19 cases and the 7-day moving average ended February at its lowest level since July 2021. This impressive decline in case growth was echoed by a similar decline in daily deaths and hospitalizations. With 65 percent of the country fully vaccinated and an additional 12 percent having received at least one shot—on top of growing natural immunity—last month’s improvement suggests that medical risks are likely to keep declining.

Despite the positive medical news, though, we then saw mid-month volatility driven by growing inflation, with the January Consumer Price Index (CPI) report showing consumer prices increasing at their fastest pace since 1982. Interest rates rose in anticipation of potentially faster monetary policy tightening from the Fed, and rising rates caused equity valuations to decline, contributing to the mid-month sell off.

The Russian invasion of Ukraine toward the end of the month caused increased uncertainty for markets—especially energy markets. While the invasion’s initial impact on U.S. equities was largely muted, the situation remains in flux and could cause more uncertainty and turbulence in the months ahead.

Ultimately, February’s shifts serve as a reminder that unexpected risks can suddenly appear and shake markets, generating significant volatility. Those risks, however, are not necessarily a good indicator of longer-term risks, or of underlying fundamental conditions.

Economic Data Improves

Despite market turmoil to start the year, February’s economic data continued to get better. The January employment report showed 467,000 jobs were added during the month, which was much better than the 125,000 that were expected. The November and December jobs reports were also revised up a net 709,000 new jobs. Many more jobs than expected is good news and should help maintain the high levels of consumer demand and economic momentum we need to ride out the current headwinds.

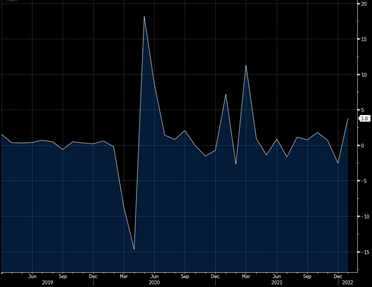

Supported by strong employment data, consumer spending also showed signs of improvement. Both personal spending and retail sales came in above expectations in January, largely offsetting declines from December that were caused by the spread of the Omicron variant. Retail sales increased 3.8 percent during the month while personal spending grew 2.1 percent. As you can see in Figure 1, this represents the best month for retail sales growth since March 2021 when federal stimulus checks spurred a surge in spending. January’s rebound in consumer spending was another encouraging signal that the momentum from 2021 carried over into the new year and continued to drive economic growth.

Figure 1. Retail Sales Monthly Percentage Change, March 2019-Present

Business confidence and spending also showed signs of continued economic growth during the month. Business confidence declined slightly to start the year, but remained in healthy expansionary territory. Core durable goods orders, which are often viewed as a proxy for business investment, increased by more than expected in January, marking 11 consecutive months with increased business spending. Businesses spent much of 2021 hiring and investing in equipment to try and meet high levels of consumer demand, and this trend appears to have continued into the new year.

The housing sector also showed signs of continued improvement during the month. Home builder confidence remained in healthy expansionary territory in February, driven by continually high levels of potential home buyer demand. January’s existing home sales report also showed faster-than-expected sales growth to start the year, and the annual pace of existing home sales hit a one-year high in January. The resilience for the housing market despite the headwinds created by Omicron and inflation at the start of the year was impressive and highlights the continued strength for the important housing sector.

Risks Remain but Growth Is Likely

As we saw in February, very real risks for markets and the economy remain. The ongoing war between Russia and Ukraine will be a major factor for political and economic uncertainty, even if the direct economic and market impact has been relatively muted in the U.S. thus far. Additionally, while we saw medical risks drop in February, we could see new waves of Covid-19 in the months ahead. Finally, inflation is high and, with the war, may increase further. While the current uncertainty may slow the Fed’s response, higher inflation could push rates even higher and lead to more market uncertainty and volatility if the central bank surprises investors.

The fundamentals for businesses and the economy, however, remain strong and show continued signs of improvement. While negative headlines and geopolitical events can draw investor attention and lead to short-term selloffs, the improving fundamentals should support markets and the economy though periods of uncertainty. Given the potential for short-term volatility, it’s important to remember a well-diversified portfolio that matches investor timelines and goals remains the best path forward for most investors. As always, if you have concerns, reach out to your financial advisor to review your financial plans.

All information according to Bloomberg, unless stated otherwise.

Disclosure: Certain sections of this commentary contain forward-looking statements based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. Past performance is not indicative of future results. Diversification does not assure a profit or protect against loss in declining markets. All indices are unmanaged and investors cannot invest directly into an index. The Dow Jones Industrial Average is a price-weighted average of 30 actively traded blue-chip stocks. The S&P 500 Index is a broad-based measurement of changes in stock market conditions based on the average performance of 500 widely held common stocks. The Nasdaq Composite Index measures the performance of all issues listed in the Nasdaq Stock Market, except for rights, warrants, units, and convertible debentures. The MSCI EAFE Index is a float-adjusted market capitalization index designed to measure developed market equity performance, excluding the U.S. and Canada. The MSCI Emerging Markets Index is a market capitalization-weighted index composed of companies representative of the market structure of 26 emerging market countries in Europe, Latin America, and the Pacific Basin. It excludes closed markets and those shares in otherwise free markets that are not purchasable by foreigners. The Bloomberg Aggregate Bond Index is an unmanaged market value-weighted index representing securities that are SEC-registered, taxable, and dollar-denominated. It covers the U.S. investment-grade fixed-rate bond market, with index components for a combination of the Bloomberg government and corporate securities, mortgage-backed pass-through securities, and asset-backed securities. The Bloomberg U.S. Corporate High Yield Index covers the USD-denominated, non-investment-grade, fixed-rate, taxable corporate bond market. Securities are classified as high-yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below.

Mark Gallagher is a financial advisor located at Gallagher Financial Services at 2586 East 7th Ave. Suite #304, North Saint Paul, MN 55109. He offers securities and advisory services as an Investment Adviser Representative of Commonwealth Financial Network®, Member FINRA/SIPC, a Registered Investment Adviser. He can be reached at 651-774-8759 or at mark@markgallagher.com.

Authored by the Investment Research team at Commonwealth Financial Network.

© 2022 Commonwealth Financial Network®