Presented by Mark Gallagher

Facing greater exposure to debt—which costs more as rates increase—small-cap stocks struggled last week. Rates rose as bond investors demanded more yield to offset hotter-than-expected inflation.

Quick Hits

- Report releases: Consumer and producer prices were hotter than expected in February.

- Financial market data: Small-caps struggled as inflation led to potential challenges via

floating rate debt. - Looking ahead: All eyes will be on the Federal Open Market Committee (FOMC) for its

March rate decision.

Report Releases—March 11–15, 2024

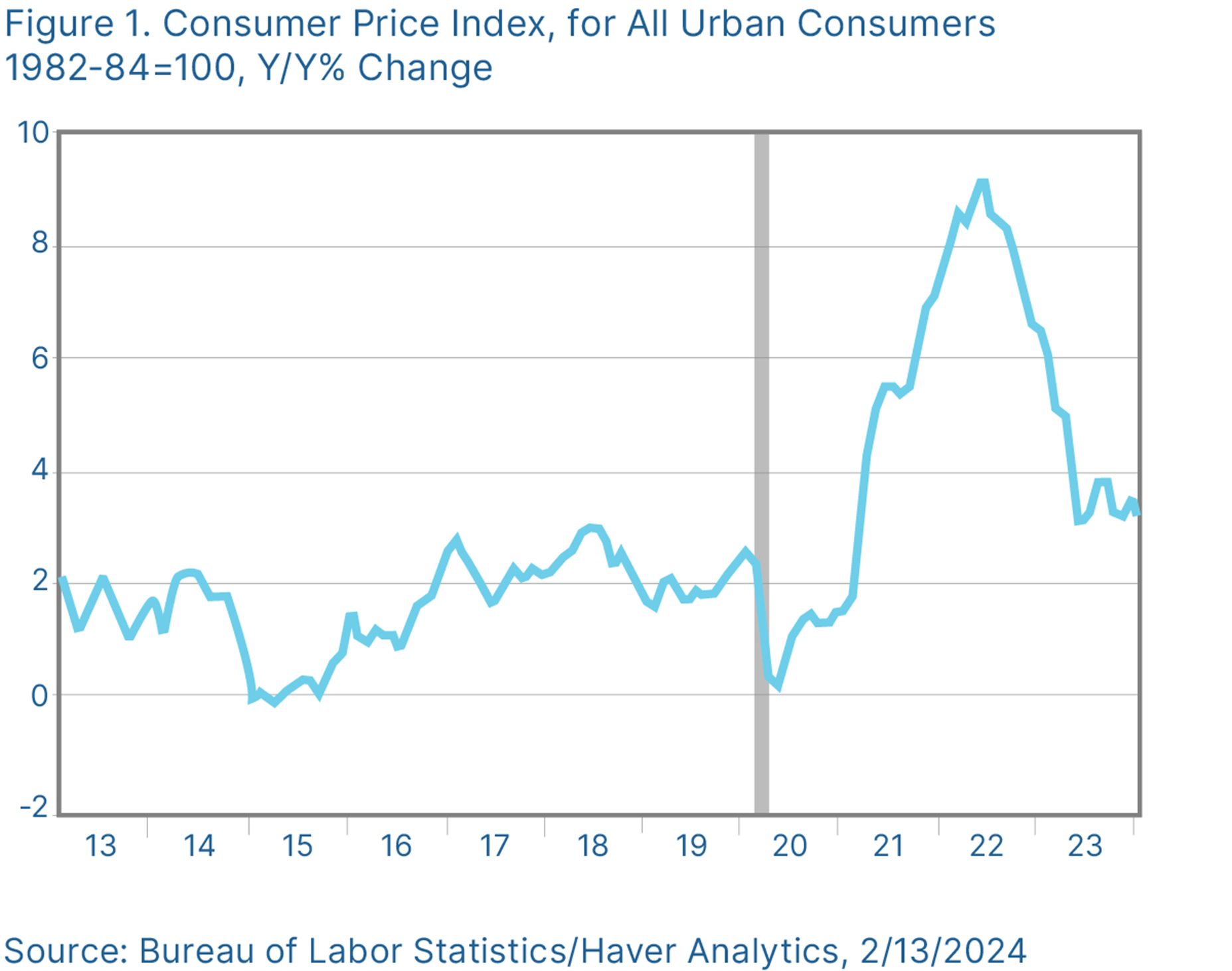

Consumer Price Index (CPI): February (Tuesday)

Headline and core consumer inflation accelerated in February, with year-over-year consumer inflation ticking up to 3.2 percent. Rising costs for shelter, gas, and used cars contributed to the rise.

-Prior monthly CPI/core CPI growth: +0.3%/+0.4%

-Expected monthly CPI/core CPI growth: +0.4%/+0.3%

-Actual monthly CPI/core CPI growth: +0.4%/+0.4%

-Prior year-over-year CPI/core CPI growth: +3.1%/+3.9%

-Expected year-over-year CPI/core CPI growth: +3.1%/+3.7%

-Actual year-over-year CPI/core CPI growth: +3.2%/+3.8%

Retail Sales: February (Thursday)

Retail sales rose in February, though the 0.6 percent increase was below economist forecasts. This lackluster result followed a downwardly revised 1.1 percent sales drop in January.

-Expected/prior month retail sales monthly change: +0.8%/–1.1%

-Actual retail sales monthly change: +0.6%

Producer Price Index (PPI): February (Thursday).

Producer prices rose more than expected in February, with the 0.6 percent rise in headline prices marking the largest monthly increase since August 2023.

-Prior monthly PPI/core PPI growth: +0.3%/+0.5%

-Expected monthly PPI/core PPI growth: +0.3%/+0.2%

-Actual monthly PPI/core PPI growth: +0.6%/+0.3%

-Prior year-over-year PPI/core PPI growth: +1%/+2%

-Expected year-over-year PPI/core PPI growth: +1.2%/+1.9%

-Actual year-over-year PPI/core PPI growth: +1.6%/+2%

Preliminary University of Michigan Consumer Sentiment Survey: March (Friday)

Consumer sentiment dipped slightly against calls for a modest increase from February’s reading.

The decrease was driven by consumer outlook for future economic conditions; sentiment around current conditions held steady.

-Expected/prior month consumer sentiment survey: 77.1/76.9

-Actual consumer sentiment survey: 76.5

The Takeaway

-Consumer and producer inflation rose more than expected in February.

-Retail sales and consumer sentiment were lower than expected.

Financial Market Data

Equity

| Index | Week-to-Date | Month-to-Date | Year-to-Date | 12-Month |

| S&P 500 | –0.09% | 0.48% | 7.63% | 31.26% |

| Nasdaq Composite | –0.68% | –0.70% | 6.58% | 37.41% |

| DJIA | 0.01% | –0.60% | 3.22% | 22.61% |

| MSCI EAFE | –1.32% | 1.92% | 4.38% | 20.16% |

| MSCI Emerging Markets | –0.12% | 1.49% | 1.38% | 12.84% |

| Russell 2000 | –2.02% | –0.65% | 0.89% | 16.95% |

Source: Bloomberg, as of March 15, 2024

The Nasdaq Composite fell for the second straight week. The Russell 2000 and small-caps led the way downward. Tesla and Meta Platforms were the primary detractors from the “Magnificent Seven.” Each was down more than 4 percent. Semiconductors and airlines were among other laggards. Airlines were led lower after Southwest said it would cut 2024 capacity amid weakness in leisure spending. Energy, materials, and consumer staples were among the top-performing sectors. West Texas Intermediate crude oil was up more than 4 percent.

Fixed Income

| Index | Month-to-Date | Year-to-Date | 12-Month |

| U.S. Broad Market | –0.04% | –1.72% | 1.63% |

| U.S. Treasury | –0.25% | –1.84% | –0.12% |

| U.S. Mortgages | 0.01% | –2.07% | 0.80% |

| Municipal Bond | 0.34% | –0.04% | 4.22% |

Source: Bloomberg, as of March 15, 2024

On the back of hotter-than-expected inflation data, Treasuries sold off heavily in the belly of the curve. The 5-year yield rose more than 26 basis points (bps), closing the week at 4.32 percent. Fixed income investors demanded more yield as inflation continued to take bites out of fixed coupon payments.

The Takeaway

-Semiconductors took a breather and airlines showed signs of weakening demand.

-Yields rose sharply in the belly of the curve as inflation was hotter than expected.

Looking Ahead

All eyes will be on the FOMC this week as Federal Reserve (Fed) Chair Jerome Powell and peers deliver their March rate decision. Several housing indicators will bookend Wednesday’s rate decision.

-The week kicks off on Monday with the release of the National Association of Home Builders Housing Market Index for March. Home builder confidence is expected to remain unchanged after reaching a six-month high in February.

-On Tuesday, we expect the release of housing starts and building permits for February. Economists expect both to rebound after falling more than expected in January.

-The primary focus this week is on the FOMC rate decision for March, expected at 2:00 p.m. ET on Wednesday. The Fed is expected to leave the federal funds rate unchanged. Economists and investors will closely watch the post-meeting news release, along with Powell’s post-meeting news conference, for potential guidance on the path of monetary policy.

-On Friday, the week wraps with existing home sales data for February. Existing home sales are expected to fall after improving more than expected to start the year. High prices, still-high mortgage rates, and a lack of supply are expected to serve as headwinds.

Disclosures: This material is intended for informational/educational purposes only and should not be construed as investment advice, a solicitation, or a recommendation to buy or sell any security or investment product. Please contact your financial professional for more information specific to your situation.

Certain sections of this commentary contain forward-looking statements that are based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. All indices are unmanaged and are not available for direct investment by the public. Past performance is not indicative of future results. The S&P 500 is based on the average performance of the 500 industrial stocks monitored by Standard & Poor’s. The Nasdaq Composite Index measures the performance of all issues listed in the Nasdaq Stock Market, except for rights, warrants, units, and convertible debentures. The Dow Jones Industrial Average is computed by summing the prices of the stocks of 30 large companies and then dividing that total by an adjusted value, one which has been adjusted over the years to account for the effects of stock splits on the prices of the 30 companies. Dividends are reinvested to reflect the actual performance of the underlying securities. The MSCI EAFE Index is a float-adjusted market capitalization index designed to measure developed market equity performance, excluding the U.S. and Canada. The MSCI Emerging Markets Index is a market capitalization-weighted index composed of companies representative of the market structure of 26 emerging market countries in Europe, Latin America, and the Pacific Basin. The Russell 2000® Index measures the performance of the 2,000 smallest companies in the Russell 3000® Index. The Bloomberg US Aggregate Bond Index is an unmanaged market value-weighted performance benchmark for investment-grade fixed-rate debt issues, including government, corporate, asset-backed, and mortgage-backed securities with maturities of at least one year. The U.S. Treasury Index is based on the auctions of U.S. Treasury bills, or on the U.S. Treasury’s daily yield curve. The Bloomberg US Mortgage Backed Securities (MBS) Index is an unmanaged market value-weighted index of 15- and 30-year fixed-rate securities backed by mortgage pools of the Government National Mortgage Association (GNMA), Federal National Mortgage Association (Fannie Mae), and the Federal Home Loan Mortgage Corporation (FHLMC), and balloon mortgages with fixed-rate coupons. The Bloomberg US Municipal Index includes investment-grade, tax-exempt, and fixed-rate bonds with long-term maturities (greater than 2 years) selected from issues larger than $50 million. One basis point is equal to 1/100th of 1 percent, or 0.01 percent.

Mark Gallagher is a financial advisor located at Gallagher Financial Services at 2586 East 7th Ave. Suite #304, North Saint Paul, MN 55109. He offers securities and advisory services as an Investment Adviser Representative of Commonwealth Financial Network®, Member FINRA/SIPC, a Registered Investment Adviser. He can be reached at 651-774-8759 or at mark@markgallagher.com

Authored by the Investment Research team at Commonwealth Financial Network.

© 2024 Commonwealth Financial Network