Presented by Mark Gallagher

Mixed month for markets ends with gains

April was a volatile month for financial markets, but early declines turned to gains at the end. The S&P 500 Index, Dow Jones Industrial Average, and Nasdaq were up 1.03 percent, 1.45 percent, and 2.35 percent, respectively.

Markets were supported by improving fundamentals. At the end of April, the blended earnings growth rate for S&P 500 companies for the first quarter was 12.5 percent, according to FactSet. All three major U.S. indices stayed above their 200-day moving averages during April, which was a positive technical sign for markets as well.

Foreign equity markets fared even better. The MSCI EAFE Index rose 2.54 percent in April, and the MSCI Emerging Markets Index gained 2.21 percent. Technical indicators were also positive for both indices.

In the fixed income space, the Bloomberg Barclays Aggregate Bond Index ended the month with a 0.77-percent gain. The high-yield market also had a positive April, as the Bloomberg Barclays U.S. Corporate High Yield Index returned 1.15 percent.

Economy improves amid signs of slowing growth

Gross domestic product (GDP) growth for the first quarter was estimated at 0.7 percent. Although disappointing, slow growth in the first quarter has been the norm during the current recovery.

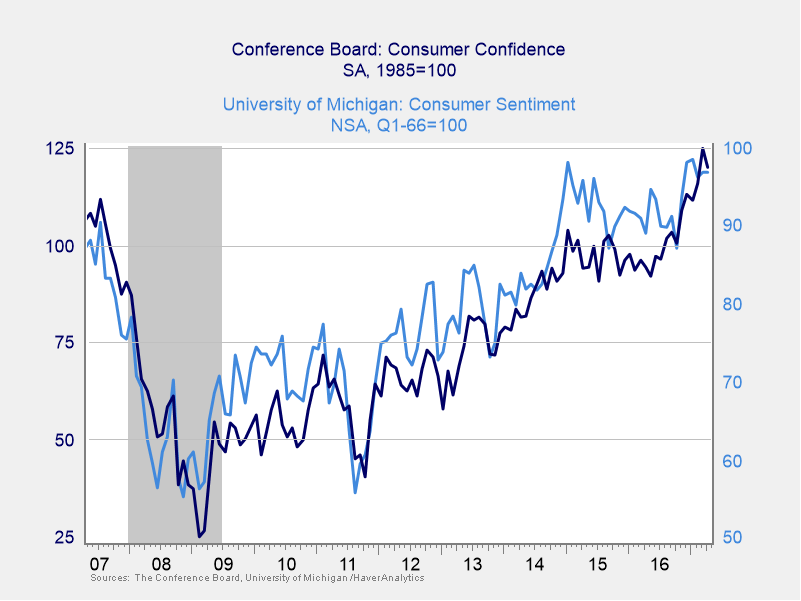

Consumer sentiment has improved substantially since last year’s election (see Figure 1). Recently, however, it has started to stabilize.

Figure 1. University of Michigan Consumer Sentiment and

Conference Board Consumer Confidence, 2007−2017

The ISM Manufacturing and Non-Manufacturing indices—important indicators of business sentiment—decreased slightly in April, but they remain at high levels. Durable goods orders, a proxy for business investment and therefore confidence, also increased.

Hard data lags soft numbers

Unfortunately, business and consumer optimism haven’t translated into real results. Consumer spending was disappointing in April. Retail sales dropped unexpectedly, and the previous month’s gain was revised to a loss. Weather and low gas prices played a role in the decline, but we need to see increases in consumer spending if we want faster growth.

On the business side, manufacturing output missed expectations and declined for the first time in seven months. In addition, results for the previous two months were revised down. Positive numbers from the last six months, however, indicate that the slowdown may be temporary.

The March employment number of 98,000 new jobs was quite weak. On the other hand, the unemployment rate and the underlying data surrounding wage growth were positive.

Housing continues to shine

Housing data came in largely better than expected in April. Home builder confidence is near post-recession highs, and an increase in building permits should lead to growth in new home supply. Existing and new home sales were also up more than expected.

Political risks continue to drive markets

In the U.S., the major political news was the Trump administration’s release of its first proposal for comprehensive tax reform. The plan includes a dramatically lower corporate tax rate, a change in the way companies are taxed on earnings in foreign countries, and fewer personal income tax brackets.

In Europe, the news was also dominated by politics. World stock markets bounced higher following first-round results in the French presidential election—widely seen as a referendum on the future of the European Union (EU). A strong EU proponent, Emmanuel Macron, is now favored to win the final election on May 7.

Meanwhile, tensions surrounding North Korea continue to escalate. So far, however, the U.S. and China appear to be working diplomatically to defuse the crisis.

Risks remain, but the future is bright

Despite real risks, the economic outlook for the rest of 2017 is solid. Multiyear highs in consumer sentiment, as well as the potential for looser regulations and tax reform, point toward the possibility of accelerated growth. How much this confidence will translate into increased spending remains to be seen. But the healthy job market and rising incomes indicate that this could happen sooner rather than later.

As always, the potential for shocks and instability continues. Therefore, a well-diversified portfolio designed around long-term needs remains the best strategy for meeting personal investing goals.

All information according to Bloomberg, unless stated otherwise.

Disclosure: Certain sections of this commentary contain forward-looking statements based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. Past performance is not indicative of future results. Diversification does not assure a profit or protect against loss in declining markets. All indices are unmanaged and investors cannot invest directly into an index. The S&P 500 Index is a broad-based measurement of changes in stock market conditions based on the average performance of 500 widely held common stocks. The Dow Jones Industrial Average is a price-weighted average of 30 actively traded blue-chip stocks. The Nasdaq Composite Index measures the performance of all issues listed in the Nasdaq Stock Market, except for rights, warrants, units, and convertible debentures. The MSCI EAFE Index is a float-adjusted market capitalization index designed to measure developed market equity performance, excluding the U.S. and Canada. The MSCI Emerging Markets Index is a market capitalization-weighted index composed of companies representative of the market structure of 26 emerging market countries in Europe, Latin America, and the Pacific Basin. It excludes closed markets and those shares in otherwise free markets that are not purchasable by foreigners. The Bloomberg Barclays Aggregate Bond Index is an unmanaged market value-weighted index representing securities that are SEC-registered, taxable, and dollar-denominated. It covers the U.S. investment-grade fixed-rate bond market, with index components for a combination of the Bloomberg Barclays government and corporate securities, mortgage-backed pass-through securities, and asset-backed securities. The Bloomberg Barclays U.S. Corporate High Yield Index covers the USD-denominated, non-investment-grade, fixed-rate, taxable corporate bond market. Securities are classified as high-yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below.

Mark Gallagher is a financial advisor located at Gallagher Financial Services at 2586 East 7th Ave. Suite #304, North Saint Paul, MN 55109. He offers securities and advisory services as an Investment Adviser Representative of Commonwealth Financial Network®, Member FINRA/SIPC, a Registered Investment Adviser. He can be reached at 651-774-8759 or at mark@markgallagher.com.

Authored by Brad McMillan, senior vice president, chief investment officer, and Sam Millette, investment research associate, at Commonwealth Financial Network®.

© 2017 Commonwealth Financial Network®